Upcoming BIL/IRA Webinars

- October 3, 2024 @ 11:00 AM – Environmental Justice Thriving Communities Grantmaking Program – ReImagine Appalachia and the Environmental Protection Network. Learn more about TCTACs here.

- October 4, 2024 @ 11:00 AM – ReImagine Appalachia Community Conversations Working Group meeting focused on barriers to employment.

- October 9, 2024 @ 2:00 PM – 3:00PM ET – DOE’ s Industrial Efficiency and Decarbonization Office (IEDO) Workforce Development Collaborative Webinar on $3 million in new DOE funding. More IEDO Program Information Here. Register Here.

- October 15, 2024 @ 2:00 PM – Financing Local Greenhouse Gas Reduction Projects – Local Infrastructure Hub with Climate United Fund, Coalition for Green Capital, and Power Forward Communities. Register Here

- October 16, 2024 @ 12:00 PM – 3:00 PM ET – ReImagine Appalachia: The Second Annual Redeveloping Shuttered Coal Plants Summit – 2nd Annual Summit for Reimagining Shuttered Coal Plants. Register Here.

- October 17, 2024– All Day Workshop, Athens, Ohio (In Person) Heartland Finance Hub – Register at: Appalachian Sustainable Finance Workshop.

- December 10, 2024 @ 2:00 PM – CCIA: Working with Community Lenders to Reduce Greenhouse Gas Emissions by Local Infrastructure Hub: Register Here

PA Home Energy Rebate Programs, which include Home Efficiency Rebates, as well as Home Electrification and Appliance Rebates – DEP will conduct in-person information sessions to discuss the development of the rebate programs. All sessions are open to the public and prior registration is encouraged, but not required. DEP is administering these rebate programs via funding provided by the U.S. Department of Energy

- Tuesday, October 15, 2024, 6PM: Brady Fire Company, 700 Maple Street, Ranshaw, PA 17866. Register here.

- Wednesday, October 16, 2024, 6PM: Montgomery County Community College, Pottstown Campus (Art Gallery on 2nd floor of North Hall), 101 College Drive, Pottstown, PA 19464. Register here.

- Thursday, October 17, 2024, 6PM: The Kingsley Association (Yoga Studio), 6435 Frankstown Avenue, Pittsburgh, PA 15206. Register here.

- Thursday, October 24, 2024, 6PM: Statewide virtual session. Register here.

New Federal BIL/IRA Program Funding Availability Announcements

Thriving Communities Grantmaking Program Now Accepting Grant Applications

Main Application Resources Page Here

Application Background – Webinar Here

GHHI’s Thriving Communities Grantmaking program, in collaboration with the EPA, will award $40 million in grants, flowing from the Inflation Reduction Act, to fund 171 eligible projects in historically disinvested communities throughout EPA’s Region 3 (includes Delaware, District of Columbia, Maryland, Pennsylvania, Virginia, West Virginia, and 7 federally recognized tribes).

New funding opportunity available for Central Appalachian communities – by Rance Garrison – Appalachian Voices – September 16, 2024 – Green & Healthy Homes Initiative & Thriving Communities Grants

The new tax credits for home solar and energy efficiency you might not know about

by Kara Holsopple – August 23, 2024 – Allegheny Front (also in WITF – Harrisburg). It’s been two years since the nation’s historic climate law, the Inflation Reduction Act, was signed. The IRA is the biggest investment in clean energy projects in U.S. history & many Americans don’t know about it even though some of its programs could directly benefit consumers, like the Residential Clean Energy Tax Credit. Flora Cardoni, deputy director of Penn Environment, looked at recent federal tax data showing that last year more than 30,000 Pennsylvania residents claimed this credit, saving them nearly $150 million on their taxes.

EPA – Reminder – Community Change Grants Program – OPEN UNTIL NOV. 21, 2024

$2 billion dollars in IRA funds for environmental and climate justice activities to benefit disadvantaged communities through projects that reduce pollution, increase community climate resilience, and build community capacity to address environmental and climate justice challenge.

New Federal Agency BIL/IRA Program Implementation Announcements

DOE Releases: Community Benefits Map for Demonstration and Deployment Projects – DOE’s map identifies where new clean energy demonstration and deployment investments are occurring and includes high-level snapshots of the community benefits that may be associated with these BIL/IRA investments.

DOE announced awards for $3 billion for 25 projects through round two of the Battery Materials Processing and Battery Manufacturing Recycling Program to create over 12,000 jobs, and enhance national security. The portfolio of selected projects, once fully contracted, are projected to support over 8,000 construction jobs and over 4,000 operating jobs. Batteries are critical to strengthening the U.S. grid, powering American homes and businesses, and supporting the electrification of the transportation sector. See more Info at: DOE’s Office of Manufacturing and Energy Supply Chains (MESC).

DOE announced $9 million in grants from the Industrial Training and Assessment Centers (ITAC) Implementation Grants program to support 47 small- and medium-sized manufacturers (SMMs) across the country to implement a wide variety of energy and efficiency projects, including installing onsite solar and heat pumps, improving lighting and heating, and electrifying industrial equipment and fleets.

DOE Announced $90 million for 25 projects under the Resilient and Efficient Codes Implementation (RECI) initiative to implement updated energy codes for residential and commercial buildings. See a full list of Awards Here.

DOE Announces Over $240 Million for New and Innovative Building Codes to Save Consumers Money, Reduce Impacts of Climate Change – August 27, 2024 – DOE

Philadelphia will receive $19.8M to design, develop, adopt, implement, and enforce a building performance standard to maximize emissions reductions from large buildings, while providing robust support programs that will ensure equitable outcomes with high compliance rates. DOE Announces additional $90 Million to Accelerate Building Code Adoption and Save Americans Money – September 16, 2024

DOE announced $70 million in Bipartisan Infrastructure Law funding for electric drive vehicle battery recycling and re-use. This is the third phase of $200 million in BIL funding support for electric drive vehicle battery recycling and second life applications. In the first phase, DOE awarded $74 million to 10 projects to advance technologies and processes for EV battery recycling and re-use. In December 2023, funding for the second phase was announced to reduce the costs associated with transporting, dismantling, and preprocessing end-of-life electric drive vehicle batteries for recycling.

DOE announced nearly $85 million across four heat pump manufacturers to accelerate the manufacturing of electric heat pumps, heat pump hot water heaters, and heat pump components, in alignment with the Justice40 Initiative.

DOE Awards More than $12 Million to 35 State & Local Governments to Support Clean Energy Local Projects and Lower Energy Costs – DOE Press Release August 28, 2024 – DOE’s Energy Efficiency and Conservation Block Grant (EECBG) Program will distribute $12.6 million to 32 local governments & two states to improve energy efficiency, reduce greenhouse gas emissions, and lower overall energy use. Grantees included: Allegheny County, PA ($751,200) & City of Erie, PA ($151,020). See DOE’s EECBG Press Release of August 28, 2024 Here.

DOE’s Energy Efficiency and Conservation Block Grant (EECBG) Program announced $16.9 million to 22 local governments including $337,960 for the City of Pittsburgh. The EECBG Program is designed to fund a wide range of energy efficiency and decarbonization projects that save energy, reduce climate pollution, and advance local energy goals. See DOE’s EECBG Press Release of September 25, 2024 Here.

DOE – $3 Million for New Initiative Will Support and Expand America’s Industrial Decarbonization Workforce – DOE’s Industrial Efficiency and Decarbonization Office (IEDO), in collaboration with the Office of Technology Transitions (OTT), announced $3 million for a new initiative to help grow the readiness of the workforce needed to decarbonize the U.S. industrial sector.

DOE Launches Energy Ready Program to Accelerate Local Clean Energy Deployment

The International City/County Management Association (ICMA) and Interstate Renewable Energy Council (IREC) launched Energy Ready, a new integrated effort funded by DOE that supports local governments with free technical assistance and recognizes their improvements in planning, zoning, and for permitting distributed energy generation.

DOE’s Energy Ready‘s suite of programs provides free technical assistance and recognition to local governments. Communities that enroll in Energy Ready receive hands-on expert support, tailored to their local area, at no cost.

DOE Invests Nearly $20 Million to Improve Siting of Renewable Energy and Co-Locate Solar with Cattle Grazing – September 10, 2024 – DOE – The Renewable Energy Siting through Technical Engagement and Planning (R-STEP) program funds state-based and Tribal collaboratives to evaluate stakeholder needs and develop state-specific educational materials and technical assistance programs to improve permitting processes for communities and industry. PA DEP Award amount – $1.96 million.

DOE’s Methane Emissions Reduction Program – Technical and Financial Assistance

DOE’s Methane Emissions Reduction Program, EPA, and DOE’s National Energy Technology Laboratory (NETL) are providing up to $1.36 billion in financial and technical assistance to improve methane emissions monitoring, detection, measurement, and quantification to reduce methane and other GHG emissions from the oil and natural gas sector.

IRS – A new Report from the Internal Revenue Service shows that more than 3.4 million American families have already claimed more than $8.4 billion in residential clean energy and home energy efficiency tax credits against their 2023 federal income taxes. IRS’ Clean energy tax credit statistics are here. See a full list of clean energy tax credits created by the IRA – Making Our Homes More Efficient: Clean Energy Tax Credits for Consumers

ARC Awards $16.9 Million to Grow Appalachia’s Infrastructure, Businesses, Workforce and Tourism Across 10 States – September 5, 2024 – Grants included: $3,889,964 to the Appalachian Investors Alliance for entrepreneurs and small businesses in PA; $500,000 to Carnegie Mellon University to plan for the expansion of job skills matching and career support services in PA; and $72,219 to the Pennsylvania Environmental Council to plan for improved trail connectivity to boost tourism.

ARC Selects 30 Community Foundations for No-Cost Training Program and Funding Opportunity – READY Community Foundations will provide 30 community foundations serving the Appalachian region with no-cost training and access to funding to expand local philanthropic impact. See PA Community Foundation Grantee List. Following completion of the training program, participants will be eligible to apply for up to $25,000 in funding (no match required) to implement internal capacity-building projects

Dept. of Interior Awards $76 Million to Plug Wells & Clean Up Legacy Pollution in PA –

Historic funding to plug orphaned oil and gas wells will address environmental and safety hazards, create good-paying jobs in communities across the Commonwealth – September 3, 2024 – Press Release – The Commonwealth expects to be able to plug approximately 550 orphaned oil and gas wells over the next five years thanks to this historic funding.

September 5, 2024 – USDA announced more than $7.3 billion in financing for rural electric cooperatives to build clean energy for rural communities through the Empowering Rural America (New ERA) program. New ERA investments in rural clean energy in the IRA make up the largest investment in rural electrification since Pres. Roosevelt signed the Rural Electrification Act in 1936 as part of the New Deal. A USDA Grant to Allegheny Electric Cooperative, Inc. will add significant carbon-free resources to its generation portfolio. The innovative project will help serve energy needs in rural portions of PA and NJ & allow Allegheny to meet over 80% of its power requirements from carbon-free resources by 2026 reducing pollution and carbon dioxide emissions by nearly 100,000 tons annually. “We’re excited to be considered a selectee for New ERA funding,” said Pennsylvania Rural Electric Association and Allegheny Electric Cooperative, Inc. President and CEO Steve Brame.

How $7.3B will help rural co-ops build clean power—and close coal plants – by Eric Wesoff, September 12, 2024 – Canary Media – This IRA program is offering 16 rural electric co-ops financing to overcome the up-front costs of shifting from coal to clean power. Rural electric cooperatives are getting their biggest federal investment since the New Deal — and this time around, the money is going to help fight climate change. USDA provided $7.3 billion in financing for 16 rural co-ops serving about 5 million households across 23 states.

NEW PA State & Local BIL/IRA Implementation Programs

Shapiro, mineworkers create apprenticeship to plug oil, gas wells – By Eric Scicchitano – CNHI STATE REPORTER – August 26, 2024 – Abandoned oil and gas wells pose widespread environmental risk to Pennsylvania, and a new apprenticeship program unveiled Monday is designed to build out a registered workforce to do the work to plug them. The Gas Well Capping Technician program is a joint initiative of Gov. Josh Shapiro’s administration and the United Mine Workers of America. UMWA will operate the program, the first of its kind for the Mine Workers, out of the its Ruff Creek Training Center in Greene County.

State announces apprenticeship program to plug abandoned oil/gas wells – August 26, 2024 Times-Leader

New state grant program means solar panels could bring deeper savings to cash-strapped Philly schools – By Sophia Schmidt, August 26, 2024 – WHYY News Climate Desk

The cash-strapped district expects to be eligible to apply for Solar for Schools grants and is currently working to identify good sites for solar.

Pa. schools can soon apply for grants to offset cost of solar projects by Rachel McDevitt – August 8, 2024 – Allegheny Front

Philly is creating its own environmental justice mapping tool with input from residents

By Sophia Schmidt, August 27, 2024 – WHYY News Climate Desk – In a series of workshops, Citizens raised concerns about illegal dumping, poorly maintained trees and air pollution.

Pennsylvania Turnpike will use excess land for 15 solar fields – by Ed Blazina

September 23, 2024 – Union Progress – The turnpike worked with nonprofit consultant The Ray, based in Georgia, to identify potential sites for solar fields. It determined the agency has about 7,900 acres that could be used for solar development.

New BIL/IRA Implementation Reports & Studies

RMI RESEARCH, ANALYSIS AND TOOLS

Bring in the Billions: How states can capture the economic potential of clean energy incentives. By Jacob Corvidae, Adefunke Sonaike, Lachlan Carey – RMI – August 16, 2024

RMI analysis of how states can reap tens of billions in IRA clean energy funding by 2031, receive on average 4% of their federal taxes “returned” through incentives, and help residents & businesses lower costs, all while attracting investment that keeps dollars local.

Batteries in Phoenix, Heat Pumps in Houston: Here’s Where Cleantech Industries Are Best Poised to Thrive by Aaron Brickman, Lachlan Carey, Ben Feshbach & Hannah Perkins – RMI – July 31, 2024 – States and localities want to raise their chances of attracting clean energy investment. Industry leaders want to find the places best suited for scaling their technologies. The Clean Growth Tool helps with both.

Maintaining Momentum of CPRG with Alternate Funding: RMI reviewed state and local project proposals under EPA’s Climate Pollution Reduction Grant program and found that the top ten most common measures proposed in state applications can be alternatively funded/financed, even if EPA did not select the project for a grant. RMI’s study discusses financing tools that can keep the momentum going and make these projects a reality.

RMI – State Playbooks for the DOE Loan Programs Office’s Energy Infrastructure Reinvestment Program (EIR) and State Energy Financing Institution Program (SEFI). These playbooks are guides for how states can set up two key programs and unlock $300 billion in low-interest federal financing to drive clean energy infrastructure in their state. These programs provide cheap capital for large renewable energy projects, hospital and education campus upgrades, industrial facility retrofits, and much more.

Other BIL/IRA Implementation Reports & Tools

States Should Spur Use of “Direct Pay” Tax Credits to Advance Clean Energy in Low-Income Communities by Rachel Jacobson and Samantha Jacoby – September 26, 2024 – Center on Budget & Policy Priorities – 70% of the IRA’s $400 billion in climate investments is in the form of these uncapped tax credits, which are available through at least 2032.

Reducing costs across America: New appliance standards save consumers money in every state – August 27, 2024 – Public Interest Research Group – National appliance efficiency standards save money for consumers and businesses, cut water waste and reduce pollution.

Recommendations for Solar with Justice: Connecting States and Communities

Warren Leon | Clean Energy States Alliance – September 26, 2024 – This paper summarizes this DOE funded project’s main recommendations for states and local governments interested in expanding solar in low- and moderate-income communities.

Accounting for Change: Policies and Technical Approaches for Reducing Greenhouse Gas Emissions through Energy Efficiency Programs – September 9, 2024 ACEEE Report

At minimum, utilities should track the GHG avoided by their EE programs, preferably using multiple accounting approaches. Furthermore, the value of avoided GHG should be embedded somewhere within EE programs, even if it is difficult to quantify with precision.

Pennsylvania News Clips on BIL/IRA Implementation

- Workers say Pittsburgh-area battery plant eligible for $2 billion in public funds is union busting – by: Kalena Thomhave – September 4, 2024 – Pennsylvania Capital-Star

- Orphaned Oil and Gas Wells Are a Huge Source of Greenhouse Gases by Nick Keppler – September 18, 2024 Sierra Club – This company is racing to fix Pennsylvania’s leaking wells

- Our opinion: Don’t waste orphan well funds – Warren Times Observer – Editorial September 18, 2024

- Pennsylvania’s Senate is trying again to overturn a regulation that would make power plants pay for pollution – by Rachel McDevitt – StateImpact – September 18, 2024 – The Pa. Senate votes along party lines to regulation that allows the state to join 10 other states in the Regional Greenhouse Gas Initiative. The RGGI rule was finalized more than 2 years ago – but has never been enforced because of court challenges.

- EPA Selects Landforce, PowerCorpsPHL For $13.9 Million Grant For Wood Reuse Workforce Development At Sites In Pittsburgh, Philadelphia – September 23, 2024

- PA Enviro Digest – Landforce and PowerCorpsPHL announced they have been selected for a $13.9 million award to support a Philadelphia-Pittsburgh partnership to create and expand two woody biomass workforce development campuses, strengthen the urban lumber and biochar market, and deploy soil-remediating biochar in both cities.

- Scientists skeptical of oil and gas company’s claim that its fracking ‘poses no public health risks’– Reid Frazier – The Allegheny Front

- New incubator launches environmental justice projects – by Ethan Woodfill September 18, 2024 – Next Pittsburgh – Twelve projects will receive support in the Allegheny, Mon and Ohio river valleys.

- RiverWise receives more federal funding to support solar power in Beaver County – by Garret Roberts – Beaver County Times – September 20, 2024 – In a recent wave of federal funding, the Department of Energy (DOE) announced that RiverWise, a Beaver County nonprofit, would receive $200,000 for its Rural Innovation through Solar Empowerment (RISE) Project. This project seeks to help rural areas in Justice40 communities access solar power. This recent wave of funding is part of Phase Two of the DOE’s Energizing Communities Prize, which previously awarded $100,000 to begin the project in 2023.

- Low-income Philadelphians continue to face high energy costs, analysis finds – By Sophia Schmidt – September 15, 2024- WHYY – A national nonprofit found Black and Hispanic households spend more of their income on energy than households overall.

- One in four low-income households in Phila. spends 16% of its income on energy bills, according to a Report from the American Council for an Energy-Efficient Economy.

- Greens Bring Green$ – September 15, 2024 – By Zach Petroff – Observer-Reporter

- The latest The Great Allegheny Passage (GAP) Economic Impact Study found that since the GAP was completed in 2013 an estimated $121 million dollars is spent annually on tourism benefiting Fayette, Allegheny, Westmoreland and Somerset counties.

- 5 Pennsylvania foundations selected for training and funding program by Madaleine Rubin – Pittsburgh Post-Gazette – August 23, 2024 – Five Pennsylvania-based community foundations were selected to participate in a training and funding program run by the Appalachian Regional Commission. The program, known as READY Community Foundations, targets under-resourced, economically distressed communities.

- Pittsburgh $2.4 million and Philadelphia $8.9 million Charging Station Awards

- Pittsburgh receives federal grant to boost a $2.9 million program for 100 electric vehicle-charging stations – by Ed Blazina August 28, 2024 – Pitts Union Progress

- Biden climate adviser Ali Zaidi, a General McLane grad, touts clean-energy sector in Pa. August 28, 2024 by Dana Massing – Erie Times-News

- Digging Deep to Understand Rural Opposition to Solar Power – By Dan Gearino

- September 26, 2024 – Inside Climate News – In a new study, Pennsylvania researchers aim to convey what drives rural attitudes on renewable energy, including how a history of coal mining affects public opinion. New research from the University of Pittsburgh helps to broaden understanding of what factors drive rural attitudes about solar power. From “Farming the sun” or “coal legacy” – “Generally, we find that supporters see solar leasing as a protector of farmland, by providing the financial means for farmers to continue farming and owning farmland.”

- Contenders in Pennsylvania Senate race shy from risky climate, energy stances while courting voters by Quinn Glabicki September 24, 2024 – PublicSource – One of four notable swing districts, Pennsylvania’s 37th Senate seat could shift the balance of power in state government. That could have big implications for climate and energy policy — but the candidates aren’t fronting those issues.

National News Clips on BIL/IRA Implementation

- Why Democrats are so quiet about climate change right now – by Maxine Joselow, August 22, 2024 – Washington Post – VP Kamala Harris and other Democrats have not made significant mentions of climate change or the environment in recent stump speeches. Volunteers for the Environmental Voter Project, which seeks to increase turnout among environmentalists, do not mention climate change that often when canvassing. Instead, they work with data scientists to identify people who are likely to prioritize the issue but have not voted in recent elections. Then they encourage them to vote by knocking on their doors and suggesting that others on their block plan to vote, too.

- All the campaign chatter about a “ban” on fracking is masking a much bigger divide about climate and energy policy. Why Harris and Trump are debating the F-word – by Ben Lefebvre, September 9, 2024 – Politico

- Big green steel project in Ohio is on again after CEO waffles – By Maria Gallucci September 19, 2024 – Canary Media – After raising doubts, Cleveland-Cliffs says it’s still pursuing a federal $500M award. The flip-flop points to the challenges of cleaning up the steel industry.

- Big Energy Issue in Pennsylvania Is Low Natural Gas Prices. Not Fracking. By Rebecca F. Elliott – September 18, 2024 – New York Times – PDF of Article – Energy businesses and farmers in western Pennsylvania are struggling because of prices, an issue that has not figured prominently in the campaigns of Donald J. Trump and Kamala Harris. Last year, oil and gas employment in Pennsylvania slid to its lowest level in at least a decade, to fewer than 20,000 jobs from nearly 35,000 in 2014, according to an analysis of federal data by ClearView Energy Partners, a research firm based in Washington.

- Number of Publicly Available Electric Vehicle Chargers Has Doubled Since Start of Biden-Harris Administration – Tuesday, August 27, 2024 – US DOT Press Release Now, Biden-Harris Administration Awarding $521 Million in Grants to Continue Building Out National Electric Vehicle Charging Network

- Europe’s Heat Pumps Put America’s to Shame by Bryn Stole, Sept. 24, 2024, The Atlantic If switching one home to a heat pump improves energy efficiency, why not whole cities?

- First “Responsible Steel” Mill Announced – U. S. Steel earns world’s first ever certification for ResponsibleSteel Certified Steel at Big River Steel – September 24, 2024 – U.S. Steel’s Big River Steel plant in Arkansas, has become the first plant to produce ResponsibleSteel Certified Steel, indicating it has passed standards in environmental, social and governance categories.

- JD Vance’s false claim that ‘green energy scam’ ships jobs to China FACT Checker by Glenn Kessler – August 12, 2024 – Washington Post – The GOP vice-presidential candidate knocks the Inflation Reduction Act, which was designed to combat China’s green energy dominance. – The Treasury Department wrote regulations that make it harder for vehicles to qualify for the full federal EV tax credit of $7,500 if key components are sourced from China, with a grace period for some rare materials like graphite. As part of the IRA, final assembly of EV models must occur in North America to be eligible. The administration in May also imposed a 100 percent tariff on Chinese EVs.

Hydrogen Hubs & Tax Credits Under the IRA

Hydrogen Hubs & Unsettled Tax Policy – The big unsettled policy question about clean hydrogen: How to use it. – by Jeff St. John – September 26, 2024 – Canary Media – Energy experts say U.S. policy must direct money to industries that really need clean hydrogen — and away from those that are better off using clean electricity. Last October, seven “clean hydrogen hub” projects were awarded a collective $7 billion in potential funding through the Bipartisan Infrastructure Law. These massive infrastructure projects are meant to kick-start the U.S. clean hydrogen industry, which some energy experts see as key to eliminating fossil fuels from sectors like steelmaking and aviation. But the plans for these projects have yet to emerge. Meanwhile, the other key pillar of U.S. clean hydrogen policy — tax credits created by the Inflation Reduction Act — is also in limbo. The rules that govern eligibility for this incentive have been the source of intense debate and are not yet finalized. In all likelihood, they will remain unsettled until after the November election. Developers are holding off on multibillion-dollar clean hydrogen investments until these rules are firm.

BIL/IRA Implementation – Highlighting Organized Labor Issues

Fair labor standards for clean energy projects are good for workers, good for the climate, and good for Appalachia – Opinion by Ted Boettner & Steve Herzenberg September 20, 2024 – PennLive

Report by Ted Boettner, ORVI – IRA Clean Energy Credits with Labor Standards Can Boost Union Jobs & Economy in Appalachia – August 23, 2024. Key takeaways:

- The IRA’s generation-based Production Tax Credit (PTC) and the capital-based Investment Tax Credit (ITC), designed to fund clean electricity investments and production, account for more than a quarter of the IRA’s estimated $900 billion in anticipated expenditures by 2031.

- 57 energy projects queued for construction across WV, Ohio, PA & Kentucky could secure a combined $2.52 billion by meeting the prevailing wage and apprenticeship (PWA) requirements necessary to secure the ITC and PTC’s full rates, a sum more than double the $1.25 billion available through the credits’ base rate. The additional funding would more than offset the projected $774 million in incremental labor costs for all 57 projects.

- Prevailing Wage requirements impose few additional costs, and they can boost productivity, workplace safety, and wages; increase the pool of skilled, qualified labor; and spur local economic growth.

- The 76 clean energy projects eligible for the PTC or ITC across Kentucky, Ohio, PA & WVA would create between 4,148 & 10,752 jobs and generate up to 6.2 million megawatt-hours of electricity, enough to power roughly 580,000 homes for a year.

- ORVI prepared an accompanying digital toolkit with sample social media content, key takeaways, and share graphics.

As Pennsylvania chooses the next president, its unions are choosing clean energy, By: Gautama Mehta, Grist & PA Capital-Star – September 18, 2024 – But even with continued fracking in the western part of the state, the state’s fossil fuel industry jobs are poised to dry up, and they have been showing signs of doing so for years. The future for the state’s energy industry is beginning to look much different than its past: Polling shows that Pennsylvanians broadly support an expansion of clean energy. That support is not just limited to climate-conscious Democrats in the state’s urban areas — it’s also beginning to show up in the industrial professions that have long depended on Pennsylvania’s legacy fossil fuel industry. In the latest sign of this shift, earlier this month a coalition of trade unions launched a new advocacy group, which is led by the state’s AFL-CIO president and is aptly titled Union Energy, to try to ensure that workers in Pennsylvania get a “just transition” to a fossil-fuel-free economy.

Union Energy – A collaboration between the PA AFL-CIO, the PA Building Trades & the Climate Jobs National Resource Center and Cornell University, Union Energy is dedicated to creating a sustainable and innovative energy economy – today – that allows all Pennsylvania families to have an opportunity to work in union jobs with union benefits

Green Banks – New Announcements

First national U.S. green bank launches with IRA funding by Lamar Johnson, ESG Dive August 23, 2024 – The Coalition for Green Capital said it’s open for business and seeking to build a U.S. network of green banks that will mobilize capital for clean energy.

The U.S. Green Bank 50 – A new era for green banks in America – Green Banks Launch Groundbreaking Partnership to Accelerate Clean Energy Investment Nationwide

U.S. Green Bank 50 Brings Green Banks Across the Nation Together to Coordinate Historic Wave of Clean Energy Investment and Provide Climate Solutions – Coalition of Forty Green Banks Invested Over $10 Billion into Communities in 2023 Alone

Nearly forty of the nation’s leading green banks, collectively responsible for more than $10 billion in new investments last year alone, announced on Monday the formation of U.S. Green Bank 50 (GB 50), a historic partnership between clean energy-focused public and nonprofit financial institutions. Press Release Here

Climate Week NYC 2024 kicks off with carbon removal deals, green banking coalition

September 24, 2024 – ESG Dive – by Lamar Johnson

The Fallout From PJM’s Record-Setting Capacity Auction

Utilities, power plant owners, state lawmakers and regulators are responding to PJM’s latest capacity auction, with an eye on the ones ahead. – September 6, 2024 – Utility Dive by Ethan Howland

PJM considers fast-track review for shovel-ready generating projects – September 5, 2024 – Ethan Howland, Senior Reporter Utility Dive

Reregulation? How utilities and states are responding to PJM’s record capacity prices

September 4, 2024 – Ethan Howland, Senior Reporter Utility Dive – PJM expects generators will step in with new supplies in response to high prices in its recent capacity auction “Houston, we have a problem” Amer. Muni. Power’s Steve Lieberman said.

Ratepayer advocates urge PJM to include RMR power plants in capacity auctions

September 3, 2024 – Ethan Howland, Senior Reporter Utility Dive – PJM should hold a stakeholder process to make the change, and, if needed, delay the next auction, set to take place in December, to avoid “unjust and unreasonable” prices, they said.

Market problems, poor planning cause price hikes in nation’s largest electric market, critics say – by: Robert Zullo – September 2, 2024 – Maryland Matters – This summer, PJM, which coordinates the flow of electricity for an area that includes all or parts of 13 states stretching from the Midwest to New Jersey plus the District of Columbia, released capacity auction results that hit a record high.

PJM says ‘concerns are growing’ after less than 2 GW added this year – September 26, 2024 by Ethan Howland – Utility Dive – “I can assure you … we very much want to bring our projects to completion and are working very diligently in doing so,” VC Renewables’ Jason Barker said.

Waiting Game: How the Interconnection Queue Threatens Renewable Development in PJM – May 18, 2024 NRDC Blog with background on PJM issue. Full NRDC Report Here.

PJM Related – DOE’s Grid Interconnection Assistance Program

DOE is offering $11.2 million in grants to distribution utilities to pilot innovative solutions for managing renewable energy and electric vehicle (EV) charging interconnection and energization queues. Many distribution utilities lack the tools and internal capabilities to manage the large volume of interconnection requests for mid-scale clean energy and flexible demand projects, like EV charging, without delays or high costs. DOE’s Innovative Queue Management Solutions (iQMS) for Clean Energy Interconnection & Energization program is accepting applications through October 16, 2024. Apply Here.

DOE Interconnection Innovation e-Xchange (i2X) program – enables a simpler, faster, and fairer interconnection of clean energy resources all while enhancing the reliability, resiliency, and security of our electric grid. The program is led by the U.S. Department of Energy’s Solar Energy Technologies Office (SETO) and Wind Energy Technologies Office (WETO) in conjunction with other DOE offices. Learn more about DOE’s i2X Program Here.

On September 6, 2024 – DOE released a Draft Roadmap with Solutions to Improve Interconnection of Rooftop Solar, EV Chargers and Other Distributed Clean Energy Resources. Comments on the Roadmap are due on October 10, 2024. Interconnection is a barrier to the growing deployment of distributed energy resources (DERs), such as distributed solar photovoltaics (PV), wind, electric vehicle (EV) charging equipment, and battery energy storage that produce and supply electricity on a small scale. The draft roadmap identifies strategies that the interconnection community can take within the next five years and beyond, which can lead to more reliable and resilience electric infrastructure for all Americans.

The document is a complement to the Transmission Interconnection Roadmap released earlier this year, which identifies near- to long-term solutions to address current challenges in transmission system interconnection.

Two-Year Anniversary of the Inflation Reduction Act

White House – The Inflation Reduction Act is tackling the climate crisis by deploying clean power, cutting pollution from buildings, transportation, and industry and supporting climate-smart agriculture and forestry. The law is accelerating our progress toward the goal of cutting U.S. climate pollution by 50 to 52 percent below 2005 levels in 2030. Fact Sheet on the IRA’s lowering costs and creating jobs is Here. In the two years, the IRA has created:

- Guidance from the U.S. Department of the Treasury (Treasury) is now available for nearly all of the Inflation Reduction Act’s clean energy tax provisions.

- Nearly two thirds of Inflation Reduction Act grant, loan, and rebate funding has been awarded.

- Clean energy projects are creating more than 330,000 jobs in nearly every state in the country, according to outside groups.

- Companies have announced $265 billion in new clean energy investments in nearly every state in the nation. According to Treasury analysis, many of these investments are happening in underserved communities – 75% of private sector clean energy investments made since the Inflation Reduction Act passed have occurred in counties with lower than median household incomes, and clean energy investment in energy communities has doubled.

- Last week, Treasury and the Internal Revenue Service released new data showing that, in 2023, more than 3.4 million American families saved $8.4 billion on home energy technologies through Inflation Reduction Act consumer tax credits. These tax credits can save families up to 30% off heat pumps, insulation, rooftop solar, and other clean energy technologies.

- New York and Wisconsin have now launched home energy rebate programs, with more states expected to launch later this summer and fall. Already, 22 states have submitted their applications to the U.S. Department of Energy to receive their full rebate funding. In total, the IRA rebates programs are expected to save consumers up to $1 billion annually in energy costs and support an estimated 50,000 U.S. jobs in residential construction, manufacturing, and other sectors.

- Since January 2024, more than 250,000 Americans have claimed the Inflation Reduction Act’s electric vehicle tax credits—either $7,500 off a qualified new electric vehicle, or up to $4,000 off a qualified used electric vehicle. In total, these taxpayers have saved about $1.5 billion and nearly all buyers claimed the incentive at the point of sale.

PennEnvironment – 2-year anniversary of Inflation Reduction Act offered opportunity to highlight the law’s potential for implementing climate solutions – September 23, 2024 – PennEnvironment hosted and participated in a series of events across the state to educate Pennsylvania about the far-reaching benefits that the Inflation Reduction Act offers for tackling climate change. Must See Event Photos!

Climate Power – TWO YEARS OF THE BIDEN-HARRIS CLEAN ENERGY BOOM

Climate Power’s latest clean energy boom report shows that in just two years the clean energy boom is especially strong in Pennsylvania, where now over $1 billion has been invested across 14 clean energy projects that have been announced or moved forward in six sectors – solar, wind, batteries, electric vehicles, electrical grid distribution and transmission, and other clean technologies.

Pennsylvania Investments in Clean Energy – Climate Power August 22, 2024

Pennsylvania highlights:

- Vitro Architectural Glass announced a $93.6 million investment to expand its Cochranton facility in Crawford County following an agreement to supply glass to First Solar, adding 130 new jobs.

- In April 2023, Prysmian announced a $22.5 million investment to expand transmission conductor technology manufacturing in Williamsport after signing a supply agreement with Invenergy Transmission, who credited the clean energy plan for providing a “stable policy landscape” for clean energy solutions.

- In March 2024, Exus North America began the necessary upgrades to repower the Twin Ridges Wind Farm in Meyersdale, Somerset County. Exus chose to repower the facility thanks to the clean energy plan’s 30% production tax credits for American wind power. The company invested $200 million to upgrade nacelles and blades on the existing towers, creating 150 union construction jobs and eight permanent service and maintenance jobs.

Click Here to learn about more investments in clean energy in Pennsylvania.

“The clean energy plan is bringing good paying manufacturing jobs to Pennsylvania – uplifting local economies and lowering energy costs, all while lowering toxic emissions,” said André Crombie, Climate Power’s States Interim Managing Director. The federal Inflation Reduction Act spurred $1.08 billion in new clean energy investments in Pennsylvania supporting 2,881 new jobs. Read full Climate Power Report on PA Here.

Public Opinion on Climate: The State of Play in 2024 – August 19, 2024 Global Strategy Group – Climate Power, EDF Action, LCV Victory Fund, NRDC Action Fund, and Global Strategy Group partnered on a new report exploring overall attitudes on climate and clean energy by simulating a debate between Democrats and Republicans on the issue. The results show that such a debate is a political winner for Democrats when discussing climate and clean energy.

Biden administration spending climate cash fast, as Trump threatens to cancel it, By Valerie Volcovici, September 18, 2024 – Reuters – Former President Donald Trump has said he would cancel all unspent funds from President Joe Biden’s signature climate law if he wins the presidential election on Nov. 5th. But the vast majority of grants will be spent by the time a new president takes office in January, and targeting what remains would be a massive legal challenge, according to Biden administration officials.

E2 Report – CLEAN JOBS AMERICA 2024 – INFLATION REDUCTION ACT DRIVES BIG GAINS IN CLEAN ENERGY JOBS – 2 Year Anniversary of the IRA – Clean energy companies added almost 150,000 jobs in 2023, growing more than three times faster than overall U.S. employment to 3,460,406 clean energy jobs nationwide. Last year’s jobs spike corresponds with the first full year of historic clean energy investments and incentives under the landmark federal Inflation Reduction Act (IRA). Only the post-pandemic recovery surge of 2021 (152,000 jobs) added more new jobs in a single year.

E2 Report – Every Day, nearly 3.5 Million Americans Across 3,000 Counties & All 50 States Work Building the U.S. Clean Energy Economy. – The IRA Drives Clean Energy Jobs The 149,170 new clean energy jobs created in 2023 accounted for 6.4% of all jobs created economy-wide, & nearly 60 percent of all jobs in the entire energy sector. This growth sets the stage as the industry begins to feel the full impact from historic investments in the IRA. 340 major new clean energy projects have been announced across 40 states since the IRA passed – private investors have said they are creating more than 109,000 new jobs with over $126 billion in investment capital. More Maps & Analysis Here – Policies Matter.

Two years in, US clean energy manufacturing boom is still going strong – by Keaton Peters – September 23, 2024 – Canary Media – The IRA has spurred more than $115B in clean energy manufacturing investment so far & the project announcements just keep coming. Since the IRA went into effect, private companies have announced a total of more than $115 billion in investments for hundreds of domestic manufacturing facilities creating solar and wind energy components, batteries, and electric vehicles, according to new figures from E2 and Energy Innovation. Those billions in investments have translated to job creation. In 2023, more than 42,000 jobs were created in the manufacturing sector for clean energy and electric vehicles, according to an E2 report.

Two-Year Anniversary of the Inflation Reduction Act: Reports and Articles on Full Implementation of BIL/IRA

Red and blue states have big climate plans. The election could upend them – by: Alex Brown – September 17, 2024 – Stateline – State leaders are nervous about Trump’s vow to undo the federal climate law. Thanks to a nearly $400 million investment from the federal government, PA is preparing a massive plan to help industrial operators upgrade to new technologies and switch to cleaner fuel sources. “Pennsylvania was one of the birthplaces of the industrial revolution, and now we’ve been given the opportunity to lead the nation in the industrial decarbonization movement,” said Louie Krak, who is coordinating the plan for PA DEP. Legal experts say Trump couldn’t outright cancel the law without an act of Congress. But climate leaders say a Trump administration could create extra barriers for grant awards, slow the approval of tax credits & delay loan requests. If the federal support becomes unreliable, projects could lose financing from the private sector.

Pennsylvania’s plans to spend federal funds on climate initiatives could be upended if Trump wins – by Alex Brown – September 20, 2024 – PA Capital-Star – Thanks to a nearly $400 million investment from the federal government, PA is preparing a massive plan to help industrial operators upgrade to new technologies and switch to cleaner fuel sources.

Columbia Law School Report – Implementing the Inflation Reduction Act: Progress to Date and Risks from a Changing Administration – September 10, 2024 – Sabin Center – Columbia Law School – The IRA is the largest investment in climate change mitigation and adaptation in American history.

- The IRA appropriates more than $142 billion to carry out activities designed to reduce greenhouse gas emissions and protect against the impacts of climate change. This includes up to $37 billion in appropriations for federal loans and loan guarantees, and nearly $105 billion allocated for grants, awards, and other direct spending by federal agencies.

- The IRA created and expanded a number of tax credit programs designed to support a broad range of climate-related activities, including investments in clean and renewable energy, electric vehicles and vehicle charging infrastructure, and energy efficiency projects.

- The total value of these tax credits is hard to evaluate since many of the IRA’s credits are not capped, but recent studies estimate that Americans may claim between $780 billion and $1.2 trillion in tax credits over the IRA’s 10-year life.

Trump vows to pull back climate law’s unspent dollars – September 5, 2024 – By Kelsey Tamborrino – Politico – The former president also pledged to establish a government efficiency commission floated by Tesla’s Elon Musk. While repealing tax credits under the IRA would require congressional action, Republicans are already looking at renewing Trump’s 2017 tax law and provisions under the IRA have emerged as potential pay-fors for that endeavor. House Republicans have also sought to repeal tax credits & other programs under the IRA — despite several House Republicans who’ve urged protecting the investments in their districts stemming from the law.

See August 6, 2024 Letter to Honorable Mike Johnson Speaker U.S. House of Representatives by 18 Members of the House Republican Conference – “Today, many U.S. companies are already using sector-wide energy tax credits – many of which have enjoyed bipartisan support historically – to make major investments in new U.S. energy infrastructure. We hear from industry and our constituents who fear the energy tax regime will once again be turned on its head due to Republican repeal efforts. Prematurely repealing energy tax credits, particularly those which were used to justify investments that already broke ground, would undermine private investments and stop development that is already ongoing. A full repeal would create a worst-case scenario where we would have spent billions of taxpayer dollars and received next to nothing in return.”

“Energy tax credits have spurred innovation, incentivized investment, and created good jobs in many parts of the country – including many districts represented by members of our conference. We must reverse the policies which harm American families while protecting and refining those that are making our country more energy independent and Americans more energy secure. As Republicans, we support an all-of-the-above approach to energy development and tax credits that incentivize domestic production, innovation, and delivery from all sources.”

Encouraging Charts & Market Notes on Solar Power

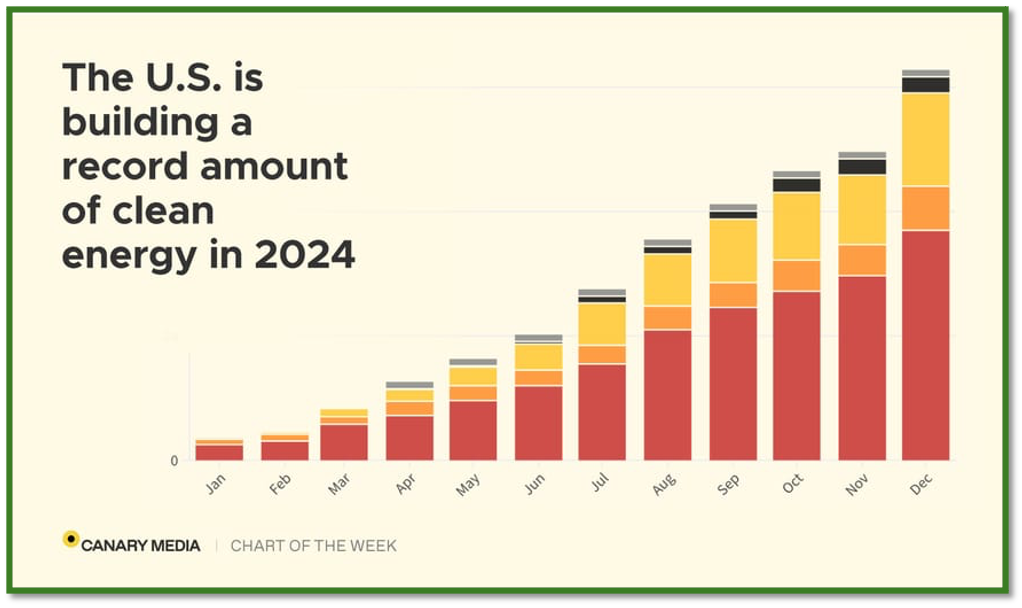

Chart: Almost all new US power plants are carbon-free – By Dan McCarthy, August 23, 2024 – Canary Media – The U.S. is pretty much only building clean energy these days, and mostly solar and batteries. The overwhelming majority – 97 percent – of the new capacity added this year came from carbon-free solar, battery storage, wind, and nuclear projects.

Solar led the way, making up 59 percent of new installations through the end of June.

Cumulative electricity capacity additions, by month, in gigawatts

US solar panel manufacturing jumps fourfold after Inflation Reduction Act – by Joelle Anselmo – Sept. 18, 2024 – Utility Dive – The sector is enjoying massive production investment thanks to the clean energy law, even as it contends with heightened tariffs.

US solar manufacturing capacity has quadrupled thanks to climate law by Eric Wesoff, September 9, 2024 – Canary Media – The Inflation Reduction Act has sparked a boom in domestic solar panel manufacturing, though the U.S. still depends on China for certain steps of the supply chain. Once upon a time, the U.S. led the way on making solar panels. Then pretty much all of its solar manufacturing capacity disappeared. Now, thanks to the Inflation Reduction Act, it’s back — and bigger than ever.

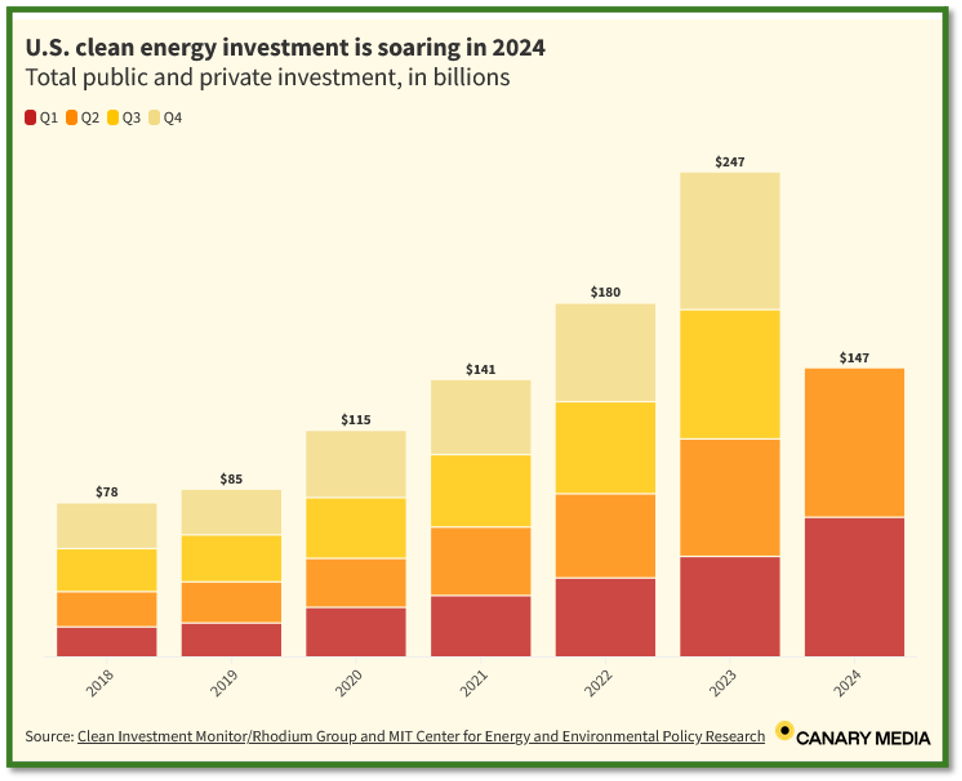

Chart: US clean energy investment is soaring thanks to climate law – By Dan McCarthy

August 16, 2024 – Canary Media – Private and public investment in clean energy rose to a total of $147B in the first half of this year — a record-setting figure.

What Will We Do With Our Free Power? – By David Wallace-Wells – New York Times

Aug. 28, 2024 – “I simply cannot believe where we are with solar,” says Jenny Chase, the Bloomberg NEF analyst and quite possibly the person in the world who knows the most about the business of turning the light of the sun into electricity. “And if you’d told me nearly 20 years ago what would be the case now, 20 years later,” she continues, “I would have just said you were crazy. I would have laughed in your face. There is genuinely a revolution happening.” By 2030, Chase estimates, solar power will be absolutely & reliably free during the sunny parts of the day for much of the year “pretty much everywhere.”

There’s now five times more solar than nuclear power in the world – PennEnvironment – September 23, 2024 – New report finds global nuclear power capacity is less than the solar added in 2023 alone.