The Inflation Reduction Act relies far more heavily on carrots than it does on sticks to induce industries to mitigate their carbon emissions. Tax credits for technologies such as carbon capture and sequestration actually exceed the costs companies would incur to implement and operate them, making the tax credits potentially valuable revenue streams. In some cases, IRA tax credits might generate as much or more revenue than product sales.

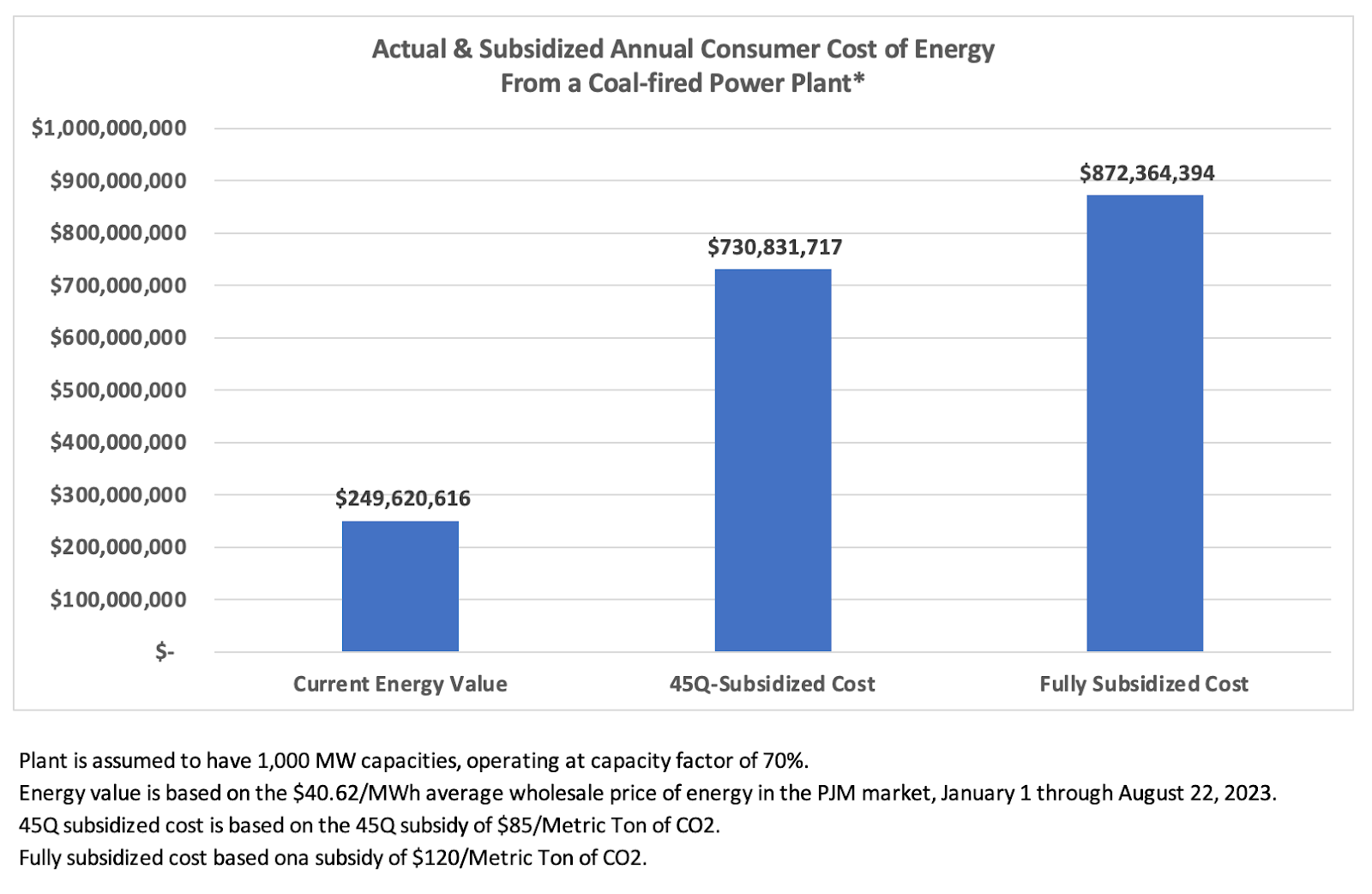

Take the example of a coal-fired power plant that installs carbon capture and sequestration technology. At current wholesale power prices, a 1,000 megawatt plant that operates 70% of the time would produce about $250 million worth of electricity annually. But, under the IRA’s 45Q tax credit for carbon capture and sequestration, if that plant were to capture 90% of its carbon emissions, it would receive about $480 million in subsidies, meaning that electricity, which currently costs about $250 million annually, would increase to $731 million, with taxpayer-funded deficit spending picking up the difference.

$480 million is a striking figure because, according to what is probably the most frequently cited study of carbon capture technology costs, the actual cost of carbon capture should only be about $388 million. So, why does the IRA provide nearly $100 million extra?

Because, if you’re trying to use a carrots-only approach to motivate a company to do something that adds to its costs and reduces output, thereby reducing both revenue and profits, you have to do way more than cover the cost of the technology. You also have to replace the lost profits, you have to cover the cost of borrowing money to implement the technology, and you have to guarantee a commercial rate of return (i.e. a healthy profit) on the required investment.

That’s expensive stuff. How expensive? Well, in the coal plant example we’ve already cited, we see that the current IRA subsidy is nearly 30% greater than the actual cost. But, as we are told by former Secretary of Energy Ernest Moniz’s organization, The Energy Futures Initiative, even that is not enough. According to EFI’s analysis, to make CCS implementation attractive to a power plant’s owners, the IRA subsidy for carbon capture would have to be increased to nearly $110 per metric ton of captured carbon. That means, instead of $480 million in public funds, the subsidy would have to be increased to about $620 million. As a result, electricity that today costs $250 million would cost over $870 million, more than three times its actual market value.

That’s a lot of money that could be used to do other things. So, before forking it over, we should at least ask, are there cheaper ways to achieve the same amount of emission reduction? Enter the stick.

Slapping a fee or tax on carbon emissions increases the operating costs for facilities like coal-fired power plants, making them less price competitive. The result is reduced production and, in some cases, outright retirement, both of which result in fewer emissions. The amount of emission reduction depends on the size of the fee or tax. But it need only be a tiny fraction of the size of the carrot.

That’s because, whereas the carrot must cover all the costs of emission reduction and then some, the stick only has to be big enough to reduce the plant’s profit margin to the point that the owners feel compelled to raise prices to levels that drive down market share or result in closure of the plant altogether.

And the stick offers one other significant advantage. It is largely paid for by the plant’s owners rather than by the public. That helps explain why, for instance, some politicians in Pennsylvania who are wildly supportive of the IRA’s $85/ton carbon capture subsidy and who have even taken measures to supplement it with additional state subsidies, are appalled and ferociously opposed to the roughly $13/ton fee that would be imposed by membership in the Regional Greenhouse Gas Initiative. The former would be paid for by taxpayers, while the latter would be paid for by the industry and its shareholders, which many policymakers seem to see as the more important constituency.

Lots of policymakers, including many who are generally progressive, really like the use of carrots because there is a flawed and erroneous perception that no one loses. And carrots do have their uses, especially when they accelerate the development of industries, such as renewable energy, whose prices are dropping and which will deliver savings in the long run.

But when carrots are applied to existing fossil fuel industries, they amount to political comfort food. They come at a steep price of increased taxes, prices, and utility bills once the subsidies expire, all of which are unnecessary because renewable energy resources, energy storage technologies, and energy efficiency offer far less expensive decarbonization solutions that would result in greater emission reductions and better economic outcomes, including more jobs.