Development of the ARCH2 hydrogen hub is unraveling due to high costs, uncertain demand, undercapitalized and inexperienced project developers, and uneconomic applications, according to a new research brief from the Ohio River Valley Institute.

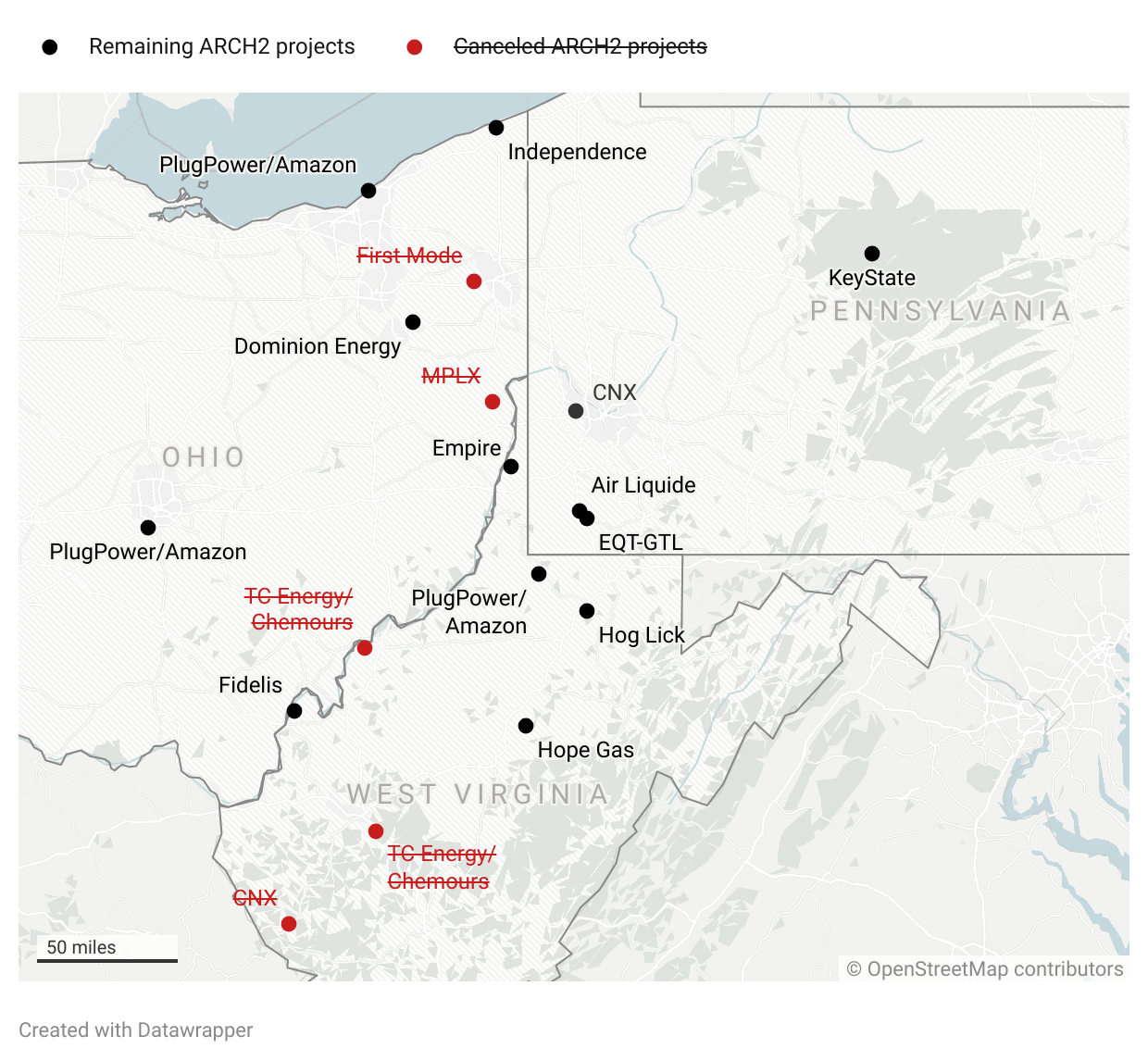

In the year since the US Department of Energy awarded ARCH2 up to $925 million in federal grants, the project has been hamstrung by financial difficulties and project dropouts. Four project development partners have exited ARCH2 and five of the 15 originally proposed projects have been scrubbed. Of the remaining project development partners, two are struggling through chronic financial crisis and two more have never developed or managed a significant industrial facility.

“ARCH2’s track record of scrapped projects and developer flight are glaring signs of risk for prospective investors, which is why, despite the federal largesse, the entire ARCH2 enterprise may ultimately amount to no more than a blip—albeit a very expensive one—on Appalachia’s economic and environmental landscape,” said author and Senior Researcher Sean O’Leary. “But if decisionmakers help shoehorn hydrogen into the uneconomic applications proposed by ARCH2, taxpayers, ratepayers, and residents could pay the price.”

Leading industry analysts describe the prospect of hydrogen production for electricity generation and home heating, end-uses proposed as part of ARCH2 by project developers TRC and EQT/Hope Gas, respectively, as “uncompetitive” and “terrible.”

Federal and state incentives to force hydrogen into uneconomic applications could pitch significant costs onto taxpayers and ratepayers. Even if the project overcomes its financial barriers, it is expected to achieve an emissions reduction of just 2% across the tri-state region, create fewer than 3,000 permanent jobs, and contribute a “miniscule” overall economic impact, the research brief finds.