Why the economic impacts of an Appalachian petrochemical buildout won’t meet expectations

A 2017 economic impact study from the American Chemistry Council paints a glowing picture of jobs growth and economic development accompanying a buildout of petrochemical facilities in Appalachia. But, we’ve been here before. We were told the same thing about the Appalachian natural gas fracking boom, which has been at best a mixed bag. A few counties in the Marcellus and Utica shale regions, including Washington County, Pennsylvania and Harrison County, West Virginia, have seen employment growth in excess of 10%. Others, such as Belmont and Jefferson Counties in Ohio have seen employment losses of greater than 10%. And many, like Pennsylvania’s three other major gas-producing counties – Susquehanna, Bradford, and Greene – haven’t seen much change at all.

That’s not what industry leaders and policy makers predicted. A decade ago, armed with an American Petroleum Institute economic impact study[1] showing that the “shale revolution” would produce 211,000 jobs in Pennsylvania and another 43,000 in West Virginia by the year 2020, they declared the industry “an economic game-changer”.

So, what happened? In most places touched by the fracking boom, the game hasn’t changed and, in some cases, it’s gotten noticeably worse. And, it’s not as though the region didn’t produce as much gas as expected. Today, Marcellus production is 45% greater than was contemplated under even the most optimistic scenario in the API study. So, why hasn’t the region seen a blossoming of jobs and prosperity?

The answer has to do with the methodology and tools that were used to forecast what turned out to be wildly optimistic outcomes. The aforementioned American Petroleum Institute study employed a tool called IMPLAN, which models the interactions of industries and government in local, regional, and national economies when they are stimulated by new investment. IMPLAN was also used in 2017 by the American Chemistry Council[2] in a study that found petrochemical industry expansion in Appalachia has the potential to generate over 100,000 new jobs.

IMPLAN attempts to quantify how business activities in one sector will affect those of other sectors by tracking the lifecycle of inputs and outputs as they wend their way through the economy in the form of investments made by industry and government, wages paid to employees, payments made to vendors, and returns retained by shareholders. In turn, these transactions trigger subsequent waves of spending and economic activity creating a multiplier effect that can be measured in the form of added wages, jobs, and tax revenues.

As you would imagine, populating the IMPLAN model with data involves many assumptions, which, as the American Petroleum Institute fracking study shows, often turn out to be wrong.

Exaggerated multipliers

Starting with the number of people who are likely to be directly employed by the investment or venture in question, the IMPLAN model relies heavily on predetermined “multipliers” to calculate how many additional jobs will be created both upstream of the venture, among companies and agencies that provide goods and services, and also downstream of the venture, as the wages that are paid to workers by the venture and its suppliers filter their way through the local economy.

Figuring out what the predetermined multipliers should be is a fraught exercise because they can vary greatly depending where the venture in question is located. If it’s in a place that has a highly developed business ecosystem of suppliers that can effectively service the new venture, then the employment multiplier will be comparatively high. But, if the venture is in a location that requires it to source services and materials from outside the region, then the multiplier will be reduced. And, although there are pre-packaged multiplier tables to provide guidance, such as the US Bureau of Economic Analysis’ Region Input-Output Modeling System (RIMS II), there are no hard and fast rules. Moreover, if the industry in question is relatively new to a region, the scarcity of relevant historical data makes even the tabled multipliers subject to error.

These bits of ambiguity open the door for . . . let’s call it unwarranted optimism, especially when the modelers are employed by parties that have a vested interest in the findings of their studies.

Double counting

The problem of exaggerated multipliers can be compounded when modelers classify workers who are included in the multiplier as also being directly employed. This sounds like an egregious blunder, but in fact, it’s common and quite difficult to ferret out since it’s not always clear which enterprises and jobs are included in the tabled multipliers and should, therefore, not be counted as part of direct employment.

Other Faulty Assumptions

In a contemporaneous review[3] of the American Petroleum Institute study on the economic impacts on Marcellus fracking, Bucknell University Professor Thomas Kinnaman identified assumptions that at the time appeared to be highly questionable and, which now in hindsight, have proven to be quite wrong.

According to Kinnaman, Considine’s study assumed that natural gas exploration and production companies operating in Pennsylvania would purchase 95% of goods and services from in-state suppliers. The study also assumed that 95% of royalty payments to property owners would be spent at in-state establishments and that 100% of those royalties would be spent within a year of being received.

However, later analyses suggest that less than half of producer purchases were made from in-state suppliers. Meanwhile, consumers typically saved rather than spent a majority of their royalty payments. And, of the portion of royalties that were spent within a year, 20% or more typically went to out-of-state businesses such as catalogs, online retailers such as Amazon, and to other out-of-state businesses located in places where people travel.

Each of these factors – lower than expected intra-regional purchasing by the venture in question, less than expected indirect and induced employment, and lower than expected spending by the venture’s employees and royalty recipients — siphons money out of the local economy and dilutes the overall impact. On top of that, the amount of money that went into the top of the funnel was also less than expected.

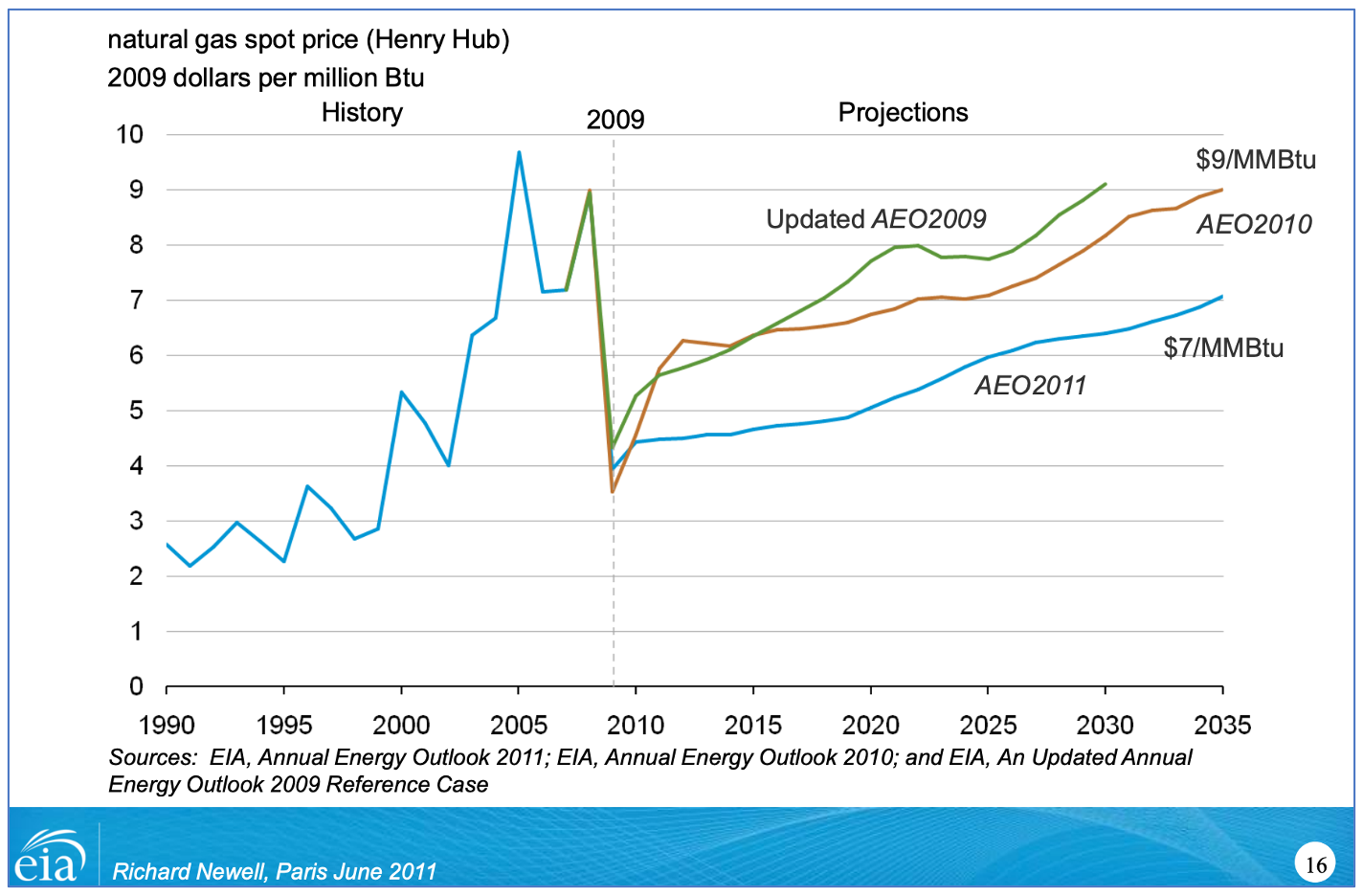

Disappointing Natural Gas Sales Revenue

The API study was conducted at a time when the Energy Information Administration assumed that the fracking boom would only cause the price of gas to fall to a low of about $4/mmbtu before gradually recovering to a price of as much as $6/mmbtu by the year 2020. In fact, since 2010, prices have occasionally dropped as low as $1.60/mmbtu and, since 2014, the average has been about $3. Consequently, even though natural gas production exceeded expectations, incomes for natural gas producers and tax revenues for the state and localities have been markedly lower than expected.

These factors go a long way to explaining why, in a 2011 analysis titled, “The Economic Value of Shale Natural Gas in Ohio”[4], economists Mark Partridge and Amanda Weinstein of The Ohio State University found that there was effectively no correlation between the number of gas wells drilled in a given county and the number of jobs.

That supposition is supported by the fact that three counties in Ohio – Belmont, Monroe, and Jefferson – which together are responsible for three-quarters of the state’s gas production, have, since 2007 seen a greater than 10% drop in the number of jobs. Given the prevalence of fracking in these three counties and the decline in the number of employed people, it’s reasonable to ask whether the fracking boom may have actually contributed to the loss of jobs. Other flaws that are common to or inherent in economic impact studies suggest how that could be a possibility.

Crowding Out Resources and Other Opportunities for Economic Growth

Economic impact modeling tools such as IMPLAN principally measure the transactional effects of projects – wages paid to workers, purchases from local suppliers, tax payments and the resulting downstream spending in the local economy by recipients of those payments. However, they don’t address costs that are imposed by projects. These externalities may include increased pollution, damage to roads and infrastructure, and greater demand for public services of all kinds.

Increased pollution can result in reduced property values, added health care costs, and reduced recreation and tourism, while also discouraging people and businesses from wanting to locate there. A true economic impact analysis would account for all of these effects. A complete study would also account for how large-scale development can hinder other forms of economic activity by reducing supply and driving up the prices of resources such as labor and housing – an effect commonly seen in places whose economies rely heavily on extractive industries, which are subject to boom and bust cycles.

Replacing Existing Jobs Rather Than Increasing Them

Finally, policymakers and others who tout predicted jobs and tax revenue impacts, often give the impression that the figures they cite are incremental to what already exists. And, frankly, that’s what many of them probably believe because it’s a misconception that industry boosters have little interest in correcting.

The truth is that many of the “new” jobs end up replacing rather than being added to jobs that already exist. As an example, we’ve all seen how a new Wal-Mart can “create” and “support” new jobs while also contributing to the destruction of jobs at nearby “mom and pop” businesses resulting in no net gain. This substitution effect can also take other forms.

Many of the 100,000 jobs claimed in a 2017 American Chemistry Council Appalachian petrochemical economic impact study would arise in plastics manufacturing. But the issue of how many of those jobs would be incremental is made fuzzy by two factors. First, both the ACC study and subsequent reports by the US Department of Energy[5] assume that 90% of the ethylene and polyethylene produced by imagined Appalachian cracker plants would be shipped out of the region to be used in manufacturing elsewhere in the country and the world. Of the 10% that would presumably stay in the region, much or most of it would serve to replace supplies that the region’s plastics manufacturers currently source from the Gulf Coast.

To the degree that Appalachian output replaces Gulf Coast output, which the DOE says will be redirected to overseas markets, it would merely support existing jobs rather than contribute to the creation of new ones. This substitution effect is likely to be significant in Appalachia because, according the most recent International Energy Association analysis, only about 10% of global demand growth for resins in coming years is likely to arise in North America. The other 90% will arise in overseas markets, principally in Asia and the middle east.

Without looking at the data that underlie the American Chemistry Council economic impact study for the Appalachian petrochemical industry, it’s impossible to know whether its assumptions about market prices and multipliers are reasonable or not. But, even if they are, we know that the study fails to account for externalities including costs, the crowding out of resources, substitution effects, and other factors, which have the potential to greatly water down or offset economic gains.

Misinterpreting Economic Impact Study Claims

The region’s policy makers should always keep in mind that, when economic studies say that a given number of jobs will be “supported” or “created”, those figures express a gross benefit, but not the net benefit, which would have to take into account the costs – something that the American Chemistry Council Appalachian petrochemical study and, before it, the American Petroleum Institute shale gas economic impact study, failed to do.

They should also bear in mind that the scenarios imagined in economic impact studies are hypothetical and oftentimes unlikely to materialize. To justify its claim of 100,000 jobs, the 2017 American Chemistry Council Appalachian petrochemical study imagined a scenario in which, by 2025, the region would see the construction of five ethane cracker plants, two dehydrogenation, plants, development of a massive natural gas liquids storage hub, and the construction of 500 miles if intra-regional pipelines tying them all together. But, it was silent on the probability of a buildout taking place on that scale.

Already we know that the study’s assumption about the timing of the buildout was unrealistic. The study was released two years after the Shell cracker plant in Monaca, Pennsylvania got the go-ahead, but since then no other component of the imagined scenario is active or has even been approved. That means a buildout certainly won’t be complete by 2025 and probably not in this decade. Second, during this period of petrochemical hibernation in Appalachia competitive capacity is growing all over the world, which means the buildout here will probably never be on the scale imagined by the American Chemical Council study.

In summary, we don’t know how much of the buildout will occur, when or if it will happen, the costs it will induce, or its net benefits. Policy makers should proceed accordingly.

[1] Timothy J. Considine. “The Economic Impacts of the Marcellus Shale: Implications for New York, Pennsylvania, and West Virginia A Report to The American Petroleum Institute”, July 2010

[2] Economics & Statistics Department, “The Potential Economic Benefits of an Appalachian Petrochemical Industry”, American Chemistry Council, May 2017.

[3] Thomas C. Kinnaman, “The Economic Impact of Shale Gas Extraction: A Review of Existing Studies”, Bucknell Digital Commons, January 2010.

[4] Amanda Weinstein and Mark Partridge, “The Economic Value of Shale Natural Gas in Ohio”, The Swank Program in Rural-Urban Policy Report, December 2011

[5] United States Department of Energy, “Ethane Storage and Distribution Hub in the United States”, November 2018