Download report Download summary & digital toolkit

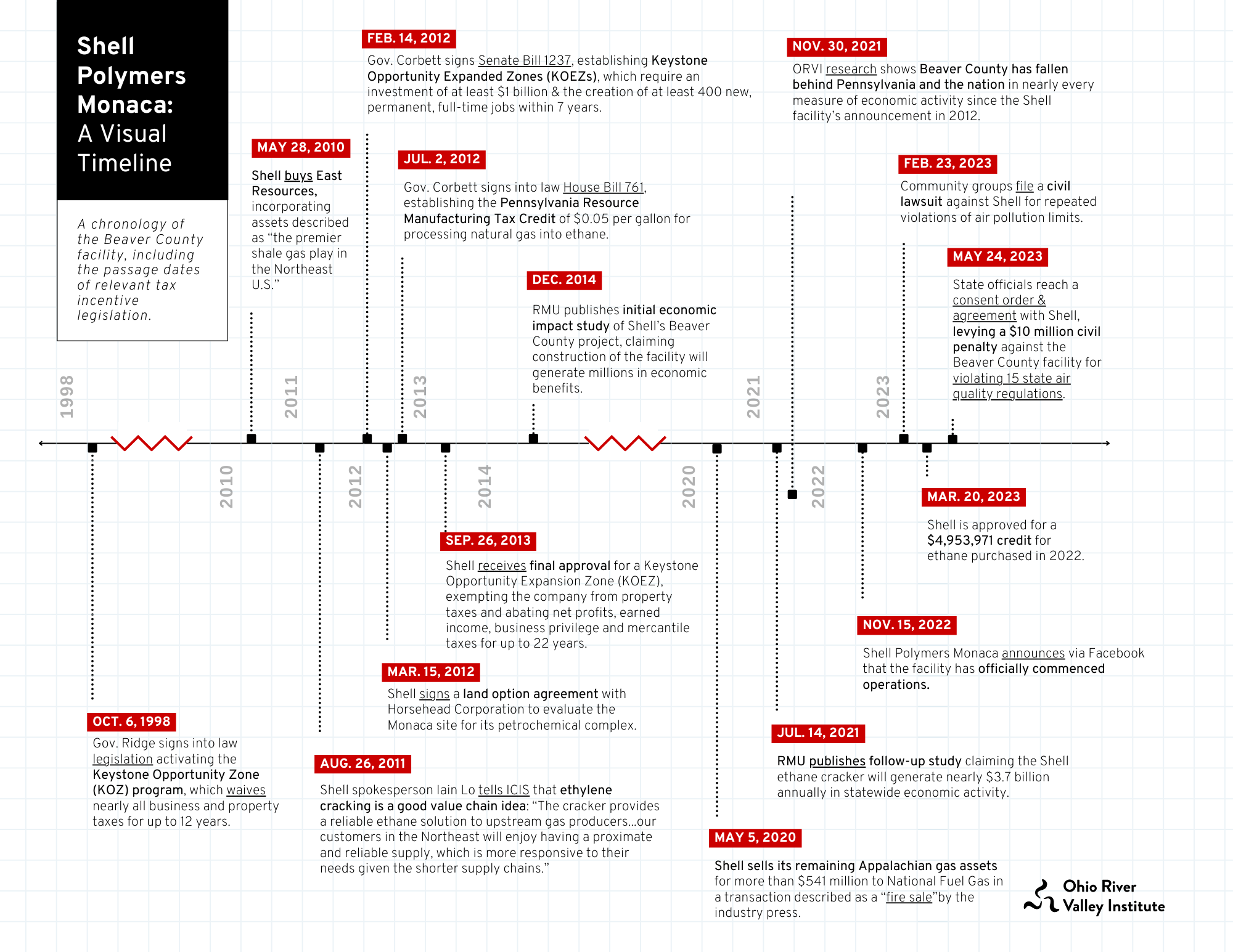

In November 2022, over ten years after Shell’s first public announcement of site selection for the project, and after five years of construction, Shell Chemical Appalachia Polymers opened its ethane cracker plant in Beaver County, Pennsylvania. The plant, which refines ethane, a natural gas liquid, into plastic pellets used to produce single-use plastics, was heralded as the beginning of a plastics industry renaissance in Appalachia. At least one local economic development organization estimated it would support nearly 600 direct employees and could generate 11,000 jobs in the Pittsburgh area.

Now, just over one year since production officially began, the plant has been mired in problems. The facility exceeded its allotted pollution limits within months of operating and repeated flaring has deepened air quality and health concerns of Beaver County residents. Furthermore, the plant seems to have fallen short so far in generating the economic benefits promised to residents, as Beaver County continues to trail the state across most economic metrics. This poor economic and environmental performance comes despite Shell receiving billions of dollars in state and local tax exemptions that carry an opportunity cost for taxpayers—namely, that alternative uses of the funds could have been used to grow the regional economy in more direct ways, such as to support small businesses, improve workforce development, or develop projects within industries that already have a strong history, complete with supply chains, in the region.

Why did Pennsylvania’s leaders in the 2010s decide to bless Shell with such generous tax incentives? A deeply flawed economic impact study conducted by professors at the Robert Morris University (RMU) School of Business in 2014 and a follow-up study published in 2021 provided rationale for these tax incentives. The goal of this report is to offer a critique of these studies, which largely went unchallenged at the time. The first study was published nearly two years after the State Assembly passed two large subsidies for the project, and just before Shell completed its purchase of the site chosen years before. Both studies were used to justify an “investment” of billions of dollars in Shell’s plan on the premise that the return-on-investment for taxpayers would be positive. It is, unfortunately, unlikely to be so.

Foremost, the circumstances in which the RMU team was solicited to do the economic study are murky. None of the authors’ curriculum vitae list any previous professional experience doing economic analysis work within the petrochemical industry. We will likely never understand Shell’s choice of authors to evaluate the project, especially given that so many field experts would have been available from other major universities both in Pittsburgh and throughout Pennsylvania.

The study was billed as an independent analysis by a university team and branded with RMU’s logo, but the study is not currently published on RMU’s website. Seemingly no record of its release by RMU exists. Correspondence with two of the RMU authors revealed that the study is the property of Shell and, thus, could not be shared with the authors of this report. Indeed, the 2014 report cover page does note that the report was financed by and prepared for Shell. The study was widely cited in media outlets in 2014, but does not appear online despite considerable search effort.

The fact that the 2014 economic study was used to justify billions of dollars of public subsidy that had already been granted to the project by the Pennsylvania General Assembly over two years earlier and is not easily accessible to the public raises serious academic and ethical concerns. For instance, a follow-up study from an RMU team co-authored by two of the 2014 report authors was released in 2021. This 2021 report does not adequately explain the methodology used to forecast tremendously positive benefits of the Shell petrochemical project, and instead refers readers to their 2014 report—which is generally unavailable. At best, citing one’s own private and publicly inaccessible work is academic malpractice, equivalent to asking serious readers to blindly trust the authors. At worst, it is a purposeful omission designed to discourage valid criticism of the study—and there is plenty of valid criticism.

The criticism of the RMU studies can be divided into four categories:

-

- It uses methodology that is not appropriate for long-term economic forecasting. The authors use commercially available economic modeling software from IMPLAN to conduct what is known as input-output analysis. While this analysis is widely used in industry, and can be valuable in some instances, it is inappropriate for long-term economic forecasting. The IMPLAN models make a series of inherent assumptions, some of which may be bad assumptions for this particular project, which involves considerable pollution and external costs. Additionally, tax subsidies provide Shell with competitive advantages over other local businesses for workers and materials. In essence, the input-output model excludes prices—meaning that it wrongfully assumes that Shell’s use of land, labor and capital are readily available and do not impact other local businesses in the region. The assumptions of input-output models are more thoroughly detailed in Table 1 of this report.

- The RMU study’s impact analysis completely omits consideration of the costs of billions of dollars in public subsidy. It is untenable to conduct a fair cost-benefit analysis and not consider the costs at all. The Shell facility receives considerable exemptions from local property taxes—revenue that would otherwise go to public services such as schools. Additionally, Pennsylvania seemingly won the project over nearby states by creating a raw material tax credit that directly subsidizes the ethane inputs for Shell’s facility. Having raw materials subsidized is a massive advantage for Shell, and this tax credit was likely needed to make the plant a profitable endeavor in the first place.

- The authors of the RMU study used a non-standard 40-year timeline to project benefits, which is highly unrealistic within the petrochemical industry. The positive forecast for the regional economy thus implausibly assumes no global market shifts, no consumer attitude shifts around single-use plastics, no political and regulatory changes, and no need to re-invest capital for upkeep or modifications to the facility for four decades. Other ethane cracker facilities in the US have used 15-year timelines for projections and evaluation.

- The RMU study utilizes incorrect industry classification codes for the project. Essentially, previous criticisms aside,even if both 1 and 2 were not valid criticisms, the RMU authors used the methodology incompetently. The code the authors used misclassified the Shell plant, as noted in a critique by Penn State Professor Emeritus David Passmore, which causes their economic model to use inflated parameters and thus overestimate the economic benefits.

For a variety of reasons, this report finds that the RMU studies present residents of the region with an inadequate evaluation of the true economic prospects of Shell’s plant. Hidden costs, including environmental degradation, chronic healthcare costs to residents due to air pollution, and declining home values near a large plastics plant, as well as the cost of what else could have been done with some of the subsidy money, are not considered. Nor does the study consider the offsetting impact of Shell’s facility crowding out investment from other local businesses by driving up construction wages and material and land prices. As a result, the RMU study does not project a net benefit to the region’s jobs—it presents an “all gravy” estimate.

This should be a cautionary tale for policymakers who are constantly presented with overly-rosy economic development projects by private companies using faulty methodologies. This is particularly true in Appalachian communities, where residents have been misled, forgotten, and fed false promises by extractive industries for the better part of a half-century. Better questions have to be asked by leaders before making decisions with public funds and the onus to thoroughly demonstrate economic benefits should be on the company seeking tax incentives. It is not enough to take anyone’s word for it without a deeper understanding of how companies and analysts arrive at their predictions. After all, as the adage goes, if something seems too good to be true, then it probably is.

In terms of economic growth, there are alternatives. Investments in workforce development, education, resident quality of life, environmental conservation, and high-multiplier small business activity, where more money remains locally instead of in out-of-state corporate headquarters, have been shown to give regions a “bigger bang for their buck.” It is the hope of this report that current and future policymakers will learn from the past and avoid making another bad bet.