“The worry is that, along the way, we are going to waste huge amounts of money on the wrong use cases for hydrogen and the wrong infrastructure in the wrong places. Worse than wasting money, we will also be wasting time – and that is the one thing we don’t have.”

—Michael Liebreich

Michael Liebreich’s comment has to do with how hydrogen will be transported and used, but his concern about wasting huge amounts of money and time are also applicable to the question of how hydrogen – specifically low-carbon or no-carbon hydrogen – will be made.

Will it be made from methane with the help of carbon capture technology that would abate some but not all greenhouse gas emissions? Or will it be made from water by means of electrolysis, which hopefully will be powered by renewable energy resources, but which may also be powered by nuclear or, depressingly, power from grids that still rely to a significant degree on fossil fuels?

The answer to these questions is a matter both of economics and policy, the latter of which is still very unsettled. But the economics at least are coming into focus and on that score a clear leader has emerged.

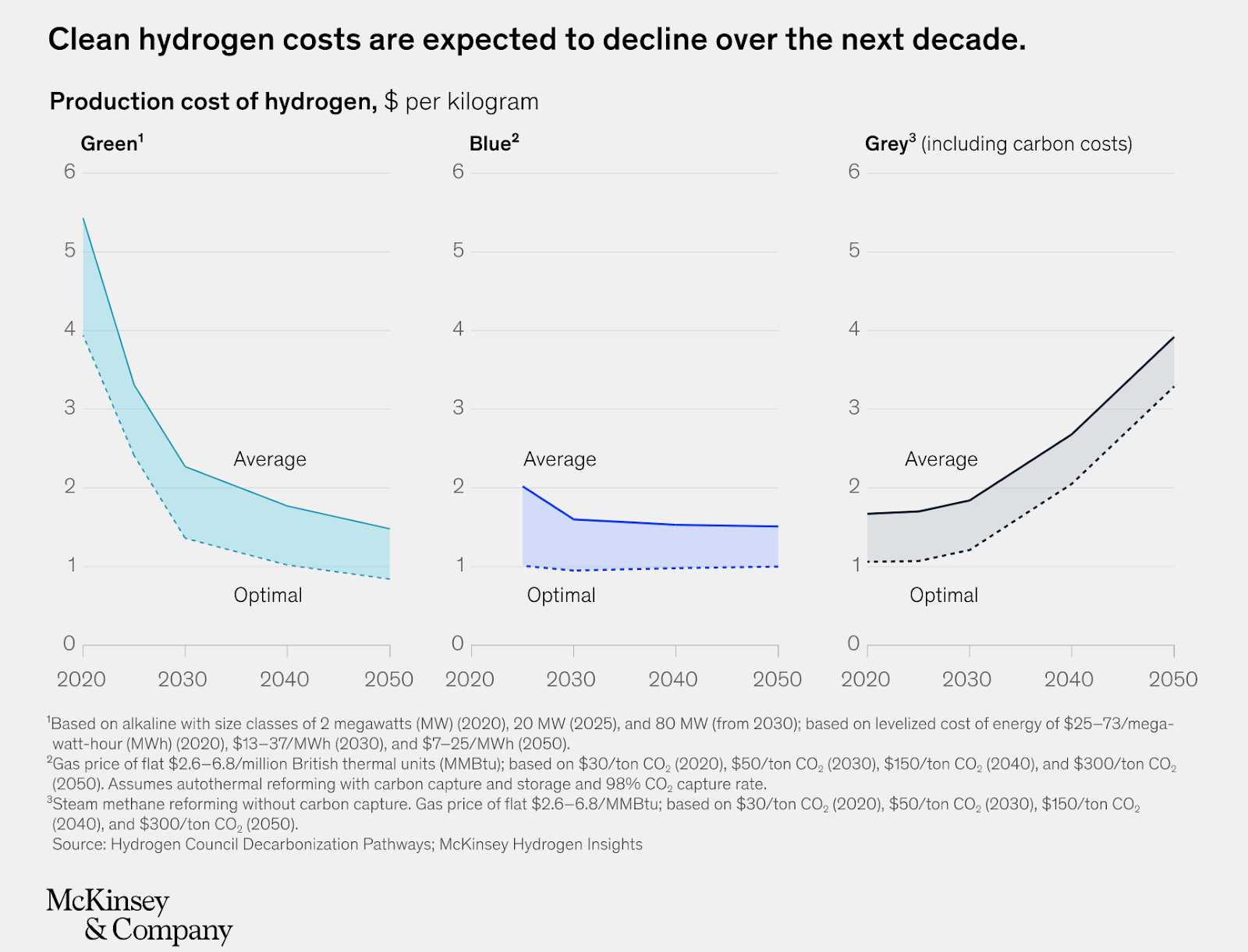

Keeping in mind that no form of low-carbon hydrogen – blue, green, or pink – is currently produced on a commercial scale in North America and that all is, therefore, speculation, it appears that by 2030 electrolyzer-manufactured hydrogen will be as inexpensive and likely less expensive than hydrogen produced from methane. That’s good because, regardless of whether the electrolysis is powered by renewable resources or nuclear, the hydrogen it produces will result in far fewer emissions and with less negative environmental and fewer economic drawbacks than its methane-based cousin. And, even if electrolysis is sometimes powered by grids which still rely somewhat on fossil fuel resources, it is reasonable to expect that over time those resources will be replaced or significantly mitigated.

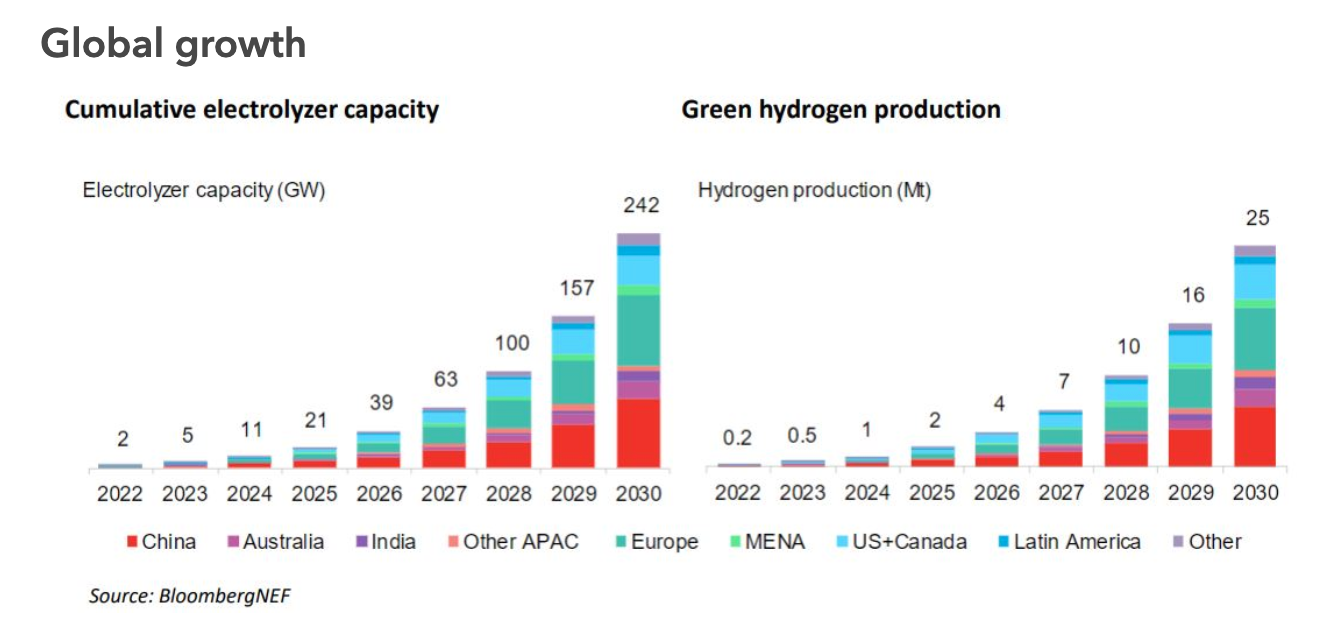

To understand why electrolyzer-manufactured hydrogen is the leader, let’s go to the numbers. Multiple analysts including Rethink Energy, Bloomberg NEF, and McKinsey are now predicting that by 2030, hydrogen will be produced by electrolyzers at an unsubsidized cost of about $1.50 per kilogram ($1.50/kg). That’s a major drop from its present cost, which is usually estimated at between $4.00 and $6.00/kg.

The reason for the anticipated price decrease is explained by Harry Morgan, a hydrogen analyst at Rethink Energy.

Green and Mean

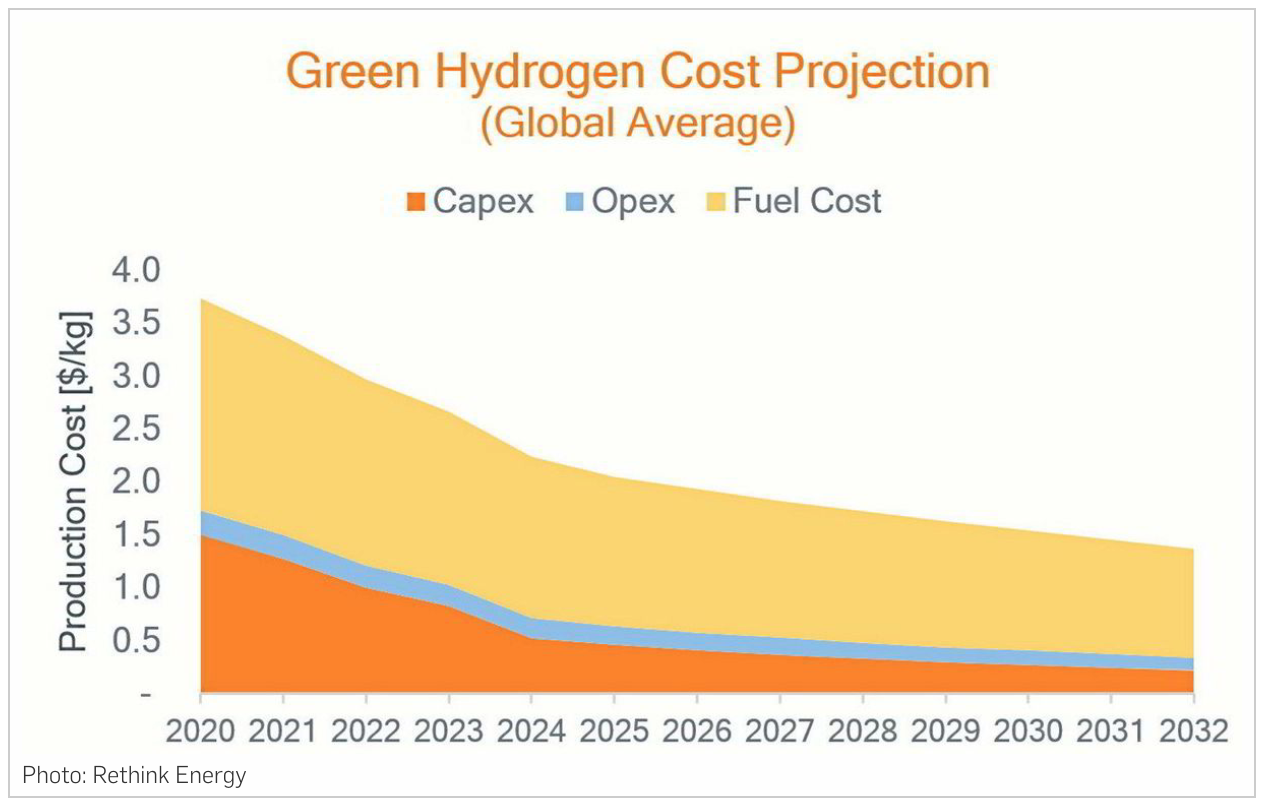

In a September 2022 article in “Recharge,” Morgan explains why, by 2030, “Rethink Energy conservatively expects the total cost of green hydrogen to sit at $1.54 per kilogram, split by electricity ($0.90 per kg), capex ($0.27 per kg), water ($0.22 per kg), and opex ($0.14 per kg).”

The majority of the decline is attributable to reduced capital expenditures (capex), which Morgan says will be driven by a combination of technological innovation and improved economies of scale as electrolyzer manufacturing and competition ramp up.

Operational expenditures (opex) will also decline due to improved efficiency as will fuel costs as the price of renewable energy continues to decline, although no longer at the breakneck pace of the past decade. Morgan calls this projection “conservative” because it presumes only an 11% average annual rate of capex cost reduction between now and 2030. By contrast, PV panels (solar), which also experienced a rapid reduction in manufacturing costs over the last decade, saw capex fall at an annual rate of 23% – a not inconceivable outcome for electrolyzers as well.

Whatever happens with electrolyzer technology, it’s going to happen fast. Bloomberg projects innovation and the expansion of manufacturing capacity and output to occur at a “breakneck” pace.

The Blue Blues

Of course, “blue” hydrogen made from methane may and probably will also experience cost reductions due to innovation in carbon capture technologies and manufacturing economies of scale. But, even if it does so at a rate comparable to that of electrolyzers, blue hydrogen faces an obstacle that electrolysis-made hydrogen does not. The cost of its feedstock, methane, places a floor beneath which the cost of CCS-enabled manufacturing cannot fall.

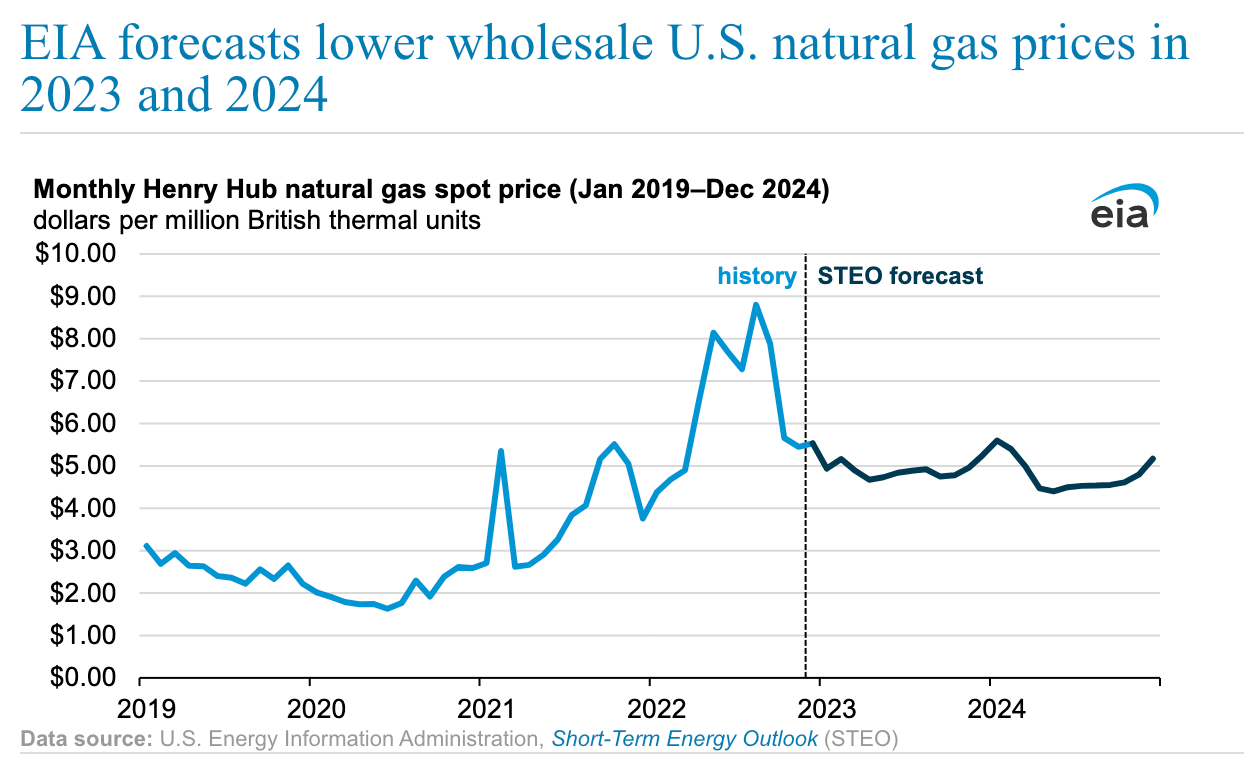

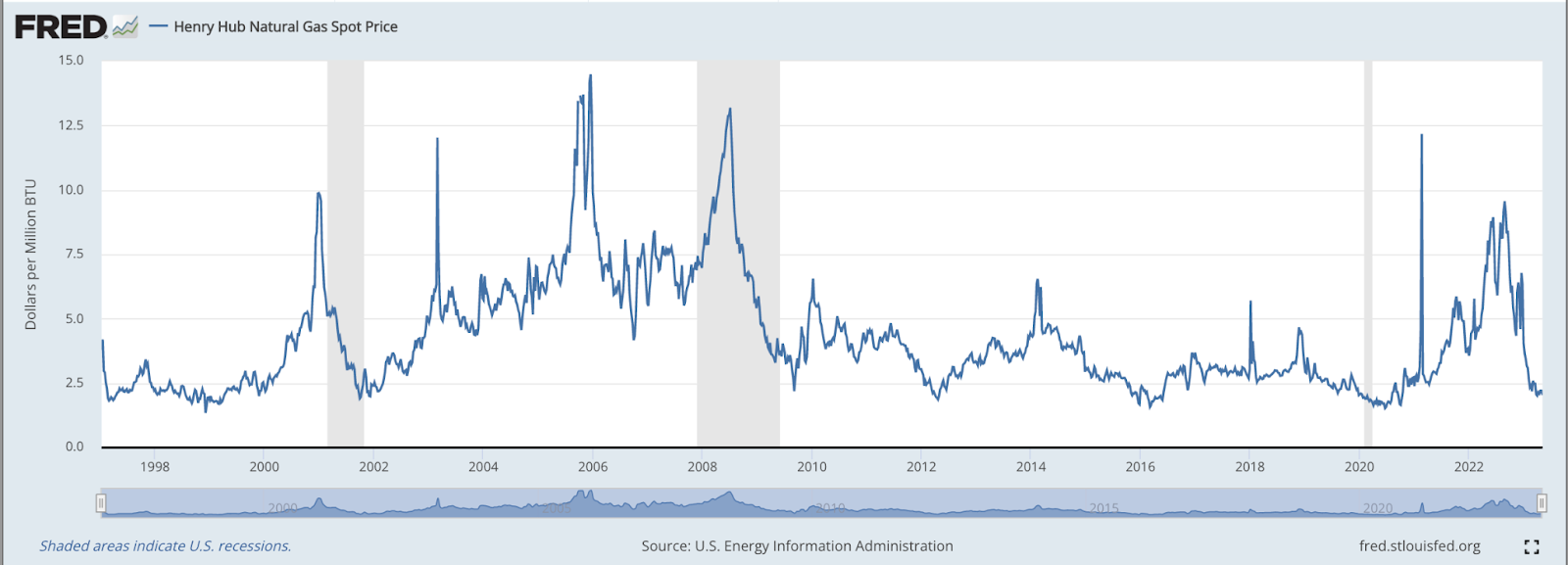

If the price of natural gas from which methane is derived remains around $2.50 to $3 per million BTUs, then blue hydrogen can be cost-competitive with green in 2030. But, as the recent EIA Short-Term Energy Outlook suggests, that may not happen.

It also does not take into account another economic variable that investors have to consider – market volatility. Natural gas is a global commodity and as the impacts of the war in Ukraine demonstrated, it is susceptible to wild price swings. In fact, even before the war in Ukraine and during one of the most price-stable decades ever experienced, the spot price for natural gas regularly fluctuated between $2 and $5/mmbtu, meaning that had blue hydrogen been competing with green hydrogen over that period, it would have struggled much of the time to remain price competitive.

That kind of uncertainty inflicts a cost on consumers and also on investors who need reliable market share and margins to know they’ll be able to recover their investments. Dreams of an Appalachian petrochemical complex collapsed in part because investors couldn’t be assured of sufficient share and margins and that might happen to Appalachian blue hydrogen as well. Or blue hydrogen manufacturing facilities might be built but discover later that they can’t compete.

We Can’t Preclude Stupidity and Corruption

All the figures that have been tossed around in this article apply to a world in which hydrogen production is unsubsidized by government. That is not the world in which we live and, at present, we don’t know what the world is going to look like because rules are still being made about the requirements that must be met for hydrogen to qualify for subsidies under the Inflation Reduction Act.

Although the IRA is very good in most respects and its authors were well-meaning, the act provides some perverse incentives for technologies like carbon capture and sequestration in hydrogen production and in the power generating sector. Those incentives could result in uneconomic investments for which taxpayers will have to pick up the tab. And we know all too well the tendency of state policymakers to give away the farm to fossil fuel interests perhaps due to corruption in some cases but probably more often because they mistakenly believe they’re doing something that will help their district and constituents prosper economically.

In short, despite the fact that green hydrogen and probably pink as well will soon be cleaner, less expensive, and more reliable than blue hydrogen, the fossil fuel industry and pliant political leaders will promote blue H2 nonetheless. The good news is that we have the economic facts as well as the environmental ones on our side and will be able to make a compelling case to policymakers who are genuinely trying to implement the most effective policies.