Key Takeaways:

- Carbon capture & sequestration (CCS) is a still unproven and spectacularly expensive decarbonization technology that may have value in industrial sectors that have no other viable decarbonization options.

- The power generating sector is a very appealing target for CCS proponents because coal and gas-fired power plants produce well over half of all point source greenhouse gas emissions and they provide thousands of prospective nodes in what could become a nationwide network of CCS pipelines and injection points.

- However, the power sector has less expensive and more effective decarbonization options in renewable energy and demand-side resources, making CCS an unnecessary expense that would add tens and perhaps hundreds of billions of dollars to the nation’s annual electric bill and perpetuate destructive practices like natural gas fracking.

It all depends on the power generating system

When proponents discuss the decarbonization potential of carbon capture and sequestration (CCS), they often make reference to hard-to-decarbonize industries such as steelmaking and cement making in which CCS may have a legitimate role given the lack of alternatives. But those who imagine going big with CCS, such as the highly influential Energy Futures Initiative, headed by former Department of Energy Secretary, Ernest Moniz, know that the real game isn’t those industries or a bevy of other manufacturing industries, such as ammonia, chemicals, petrochemicals, paper, ethanol, metals, minerals, and refining. The real game is fossil fuel power generation.

The fossil fuel power generating sector—coal and gas-fired power plants—produces more capturable carbon dioxide than all of the other industries combined. And, in the vast interior of the United States, from Pennsylvania to the Rockies, it’s responsible for two-thirds of capturable emissions.

That’s why, if CCS is going to be more than a niche technology in decarbonization efforts, it will have to become a major player in power generation. But that’s a problem. In addition to helping perpetuate highly polluting industries such as natural gas fracking and coal mining, implementing CCS can more than double the cost of generating electricity with coal and gas at a time when prices for wind and solar power plus storage have plummeted to a level sometimes below that of gas and coal power—even before the cost of CCS is added.

So, in addition to well-documented and yet-to-be resolved technological and environmental challenges, CCS is also hampered by its lack of competitiveness in the power sector. And that might be the end of the matter were it not for two factors. First, the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA) provide ludicrously large subsidies for CCS and, second, politically influential industries and unions are lobbying for additional subsidies and regulatory favors to support CCS, specifically because they have vested interests in perpetuating coal and gas power generation.

This combination of political power and immense subsidies, along with an expectation of more to come, keeps the possibility of large-scale implementation of CCS in the fossil fuel power sector alive and, with it, the possibility of spectacularly extensive and expensive pipeline projects that would be required to transport and sequester captured carbon from the power sector.

A coast-to-coast web of pipelines and sequestration sites

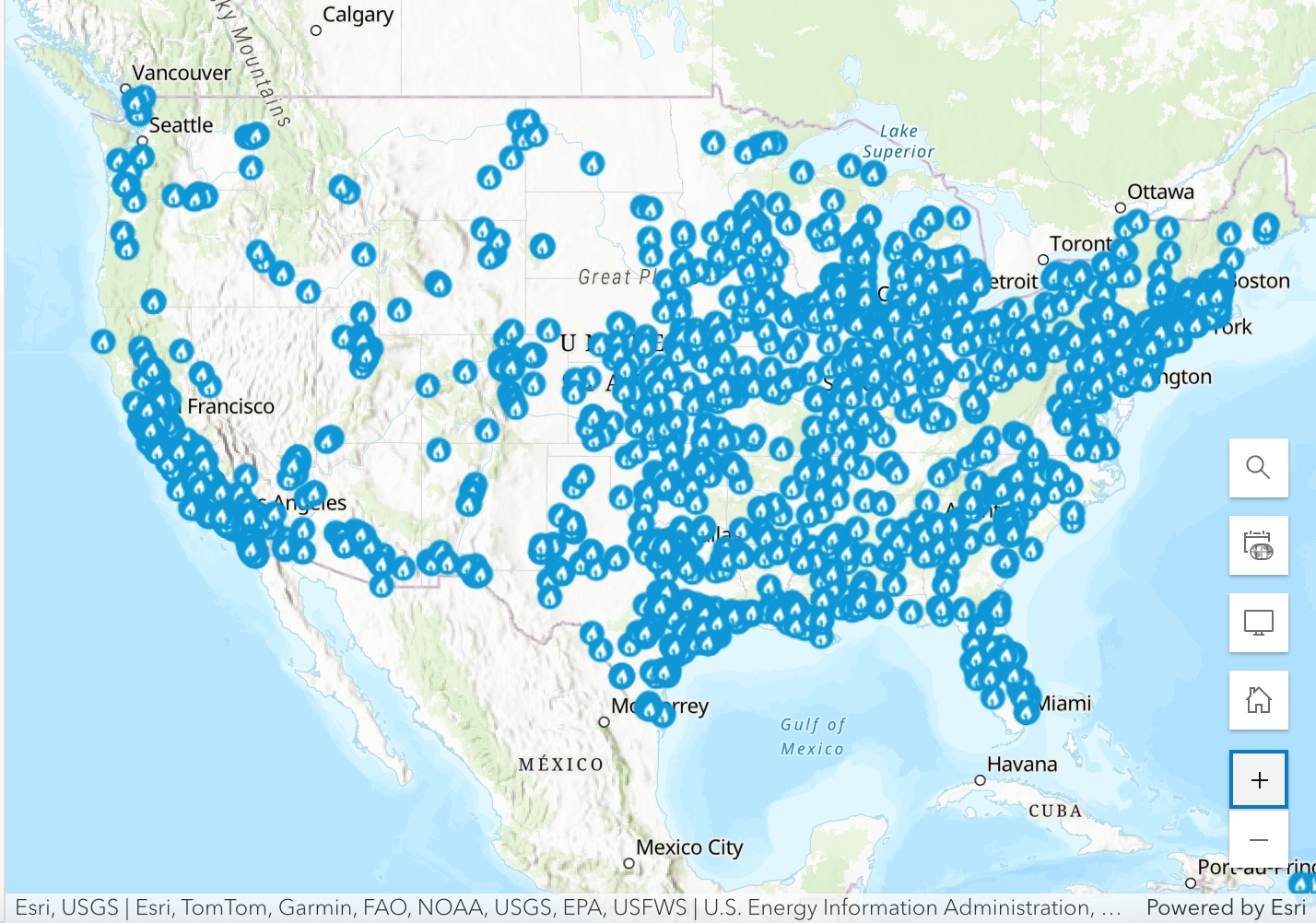

The extent of the CCS infrastructure network that some proponents imagine is illustrated by this map created by the Great Plains Institute. It depicts many thousands of miles of theoretical CO2 pipelines and storage sites that reach into every region and nearly every state in the continental United States.

Source: Great Plains Institute

The cost of such an extensive pipeline network would run into the hundreds of billions of dollars.

And many of the nodes on the map, which represent emitting facilities, correspond with the locations of gas- and coal-fired power plants. The following map shows the distribution of the nation’s 2,000+ gas-fired power plants.

Source: EIA

At the time GPI created its map, which was prior to passage of the Inflation Reduction Act, a little over 1,300 coal and gas-fired power plants emitted enough carbon to qualify for subsidies under section 45Q of the federal tax code. The IRA expanded eligibility and, at present, the Environmental Protection Agency is developing new emission standards for gas-fired power plants, which may force plants that otherwise might not have considered CCS to do so in order to meet stricter emissions caps.

As a result, the number of coal and gas plants that either might want to or might have to implement carbon capture in order to keep operating may grow considerably. Also, the US still has 216 coal plants in operation.

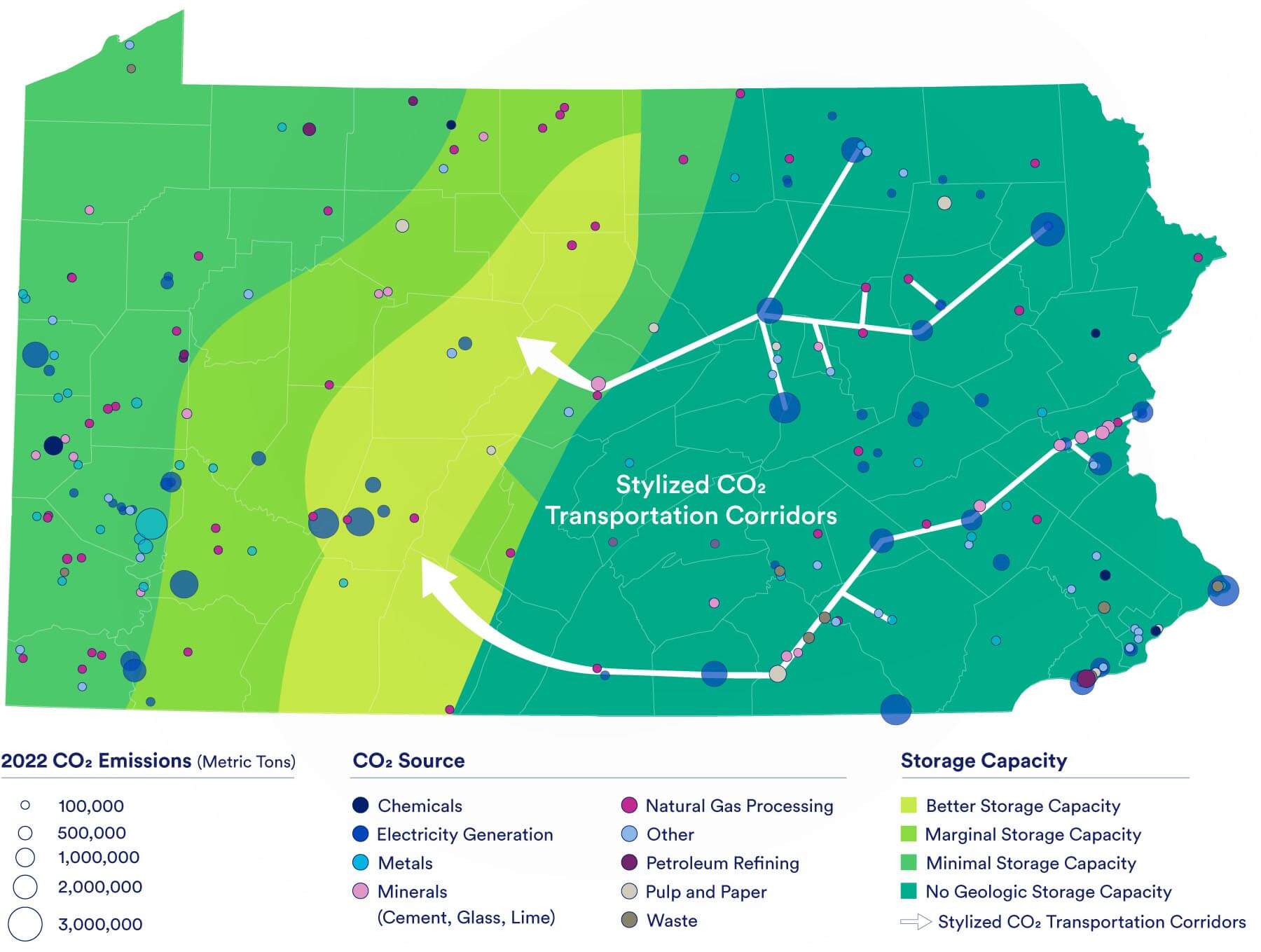

This combination of sheer numbers, wide geographic dispersion, and high concentrations of CO2 emissions make fossil fuel power plants critical to the realization of the nationwide CCS network imagined by the Great Plains Institute and other proponents. That is why, when the Clean Air Task Force, another organization that supports widespread CCS deployment, envisioned a CCS hub in Pennsylvania, it developed a map in which all of the major emitting facility nodes are gas-fired power plants.

Source: Clean Air Task Force

In CATF’s vision, pipeline routes are basically dictated by the geography of fossil fuel power plants, with other kinds of emitting facilities allowed to glom on as fate and occasional pipeline offshoots permit.

Why are power plants prioritized in both the GPI and CATF models? Because, without their participation and the large volumes of carbon they bring to the table, it will be almost impossible to cost-effectively amortize the huge amounts of capital that a nationwide CO2 transportation and storage network will require.

Of course, many of us would argue that it will also be impossible to cost-effectively amortize the infrastructure capital costs even if coal and gas-fired power plants are included. Here’s why.

What would CCS do to the cost of electricity?

There has never really been much disagreement about the cost of carbon capture and sequestration in the power generating sector. In 2020, William J. Schmelz, Gal Hochman, and Kenneth G. Miller of Rutgers University found that implementing CCS in the northeastern and midwestern United States would cost $52 to $60 per metric ton of carbon captured in coal-fired power plants and $80 to $90 per ton in gas plants.

The Schmelz study has been cited by proponents of CCS such as the Energy Futures Initiative, which has been highly influential in forming Biden administration decarbonization policy, and by opponents to widespread CCS deployment, such as the Ohio River Valley Institute. Also, when the Inflation Reduction Act was written, the 45Q tax credit for carbon capture and sequestration at power plants and industrial facilities was set at $85 per metric ton of CO2, consistent with the amounts Schmelz et al projected for the coal and gas power generating sectors.

This provision means that, regardless of future technological improvements that might increase the efficiency and lower the cost of CCS, the cost to American taxpayers will remain constant — or even increase if federal or state governments choose to throw additional subsidies at CCS. But we’ll come back to that subject later. For now, the question is what a taxpayer-funded subsidy of $85 per metric ton of carbon will do to the price of electricity and whether it is a reasonable price to pay.

In many of the industrial sectors mentioned earlier—ammonia, ethanol, cement, steel, and others—one might argue that CCS is a necessary decarbonization solution because, despite the cost, there are few, if any, viable alternative solutions. But the power generating sector is different. It’s rife with alternative decarbonization strategies, starting with wind and solar power but also including various forms of energy storage, energy efficiency, and assorted grid management techniques such as demand response. So the question isn’t just what does carbon capture cost in the power sector, but also, are there better and cheaper alternatives?

There are certainly better alternatives. The renewable energy technologies just mentioned would almost entirely eliminate CO2 emissions as well as many other local air and water pollutants. CCS, on the other hand, is only expected to reduce CO2 emissions by about 90% when it’s deployed. And even that expectation is highly speculative given the real-world experience with CCS performance to date, which, as documented by the Institute for Energy Economics & Financial Analysis (IEEFA), has been underwhelming.

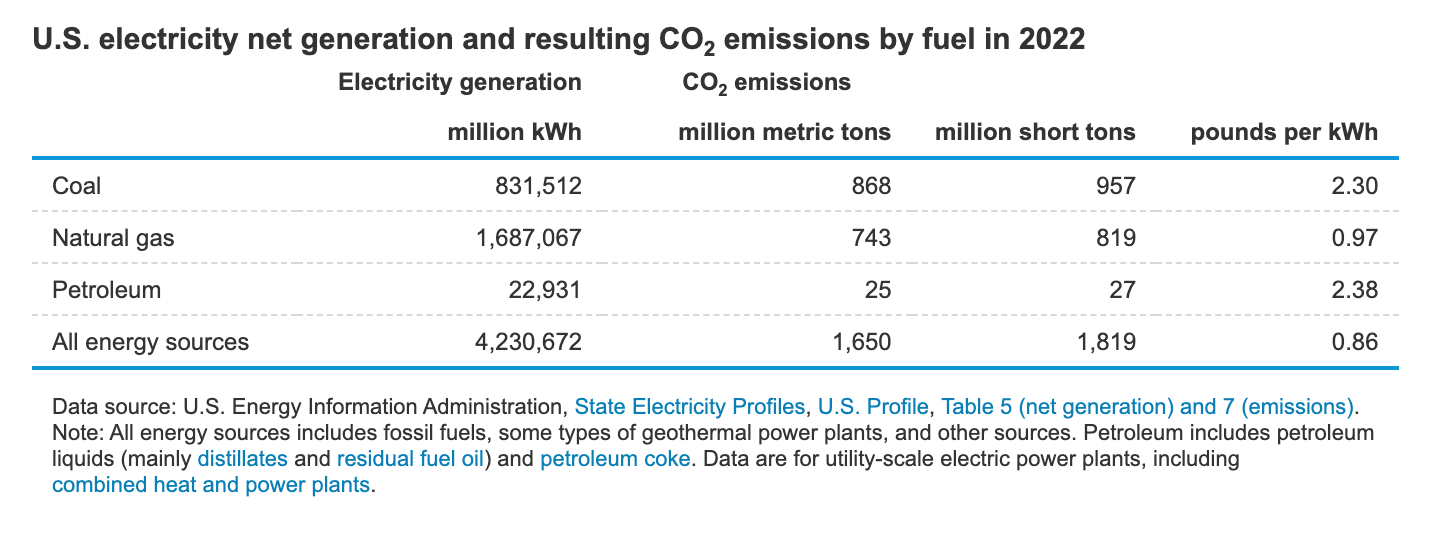

Calculating the incremental cost that widespread adoption of CCS would impose on customers is fairly easy to do. According to the Energy Information Administration (EIA), in 2022, coal-fired power plants emitted 1.04 metric tons of CO2 for each megawatt hour (MWh) generated.

Source: EIA

If we assume that 90% of the CO2 (.94 MTCO2) will be captured and sequestered for each MWh, the cost of CCS in coal-fired power plants at the 45Q rate of $85/MTCO2 comes to $79.86/MWh, or about 8 cents per kilowatt hour. That is on top of the cost of generating the electricity, which, across all generating resources nationwide, had an average cost of $63.60/MWh in 2023.

From a customer perspective, that means that, if all coal-fired generation were retrofitted for CCS—675 million MWh in 2023—the additional annual cost of electricity would be $53.9 billion. Fortunately, not every coal plant would be retrofitted for CCS because many are so old and decrepit they are likely to retire regardless of the value of federal and state subsidies. But, for those that continue operating with CCS, the additional cost of $79.86/MWh constitutes a 126% price hike. And, in the still heavily coal-dependent PJM market, which includes 13 states and the District of Columbia, the increase would be 190%, or a near-tripling of the current cost, because PJM’s average wholesale price of electricity in that market is about one-third less than the national average.

On a percent basis, the size of the price increase for gas power would be less. That’s because less carbon intensive natural gas emits only .44 metric tons of CO2 per MWh when it is combusted to generate electricity. So, if 90% of the emissions are captured at the 45Q cost of $85/MTCO2, the cost increase would be $33.66/MWh, or an increase over the average national wholesale price of 53% and an 80% increase in PJM. The bad news is that, because we generate over twice as much electricity with gas as with coal, the total out-of-pocket cost to consumers based on 2022 generation would be even more for gas than for coal—$56.8 billion.

That said, not every coal and gas plant would be retrofitted for CCS. However, if just half of the coal and gas plants were retrofitted, the wholesale cost of energy in the United States would rise from $265.7 billion in 2023 to $321.1 billion, a 21% increase amounting to about $165 annually for every American.

However, as generous as the $85/MTCO2 45Q subsidy is, there is every indication that it’s not the end of the cost increase. The power generating industry is likely to demand more . . . a great deal more.

Covering the cost of CCS is just the beginning of required subsidies

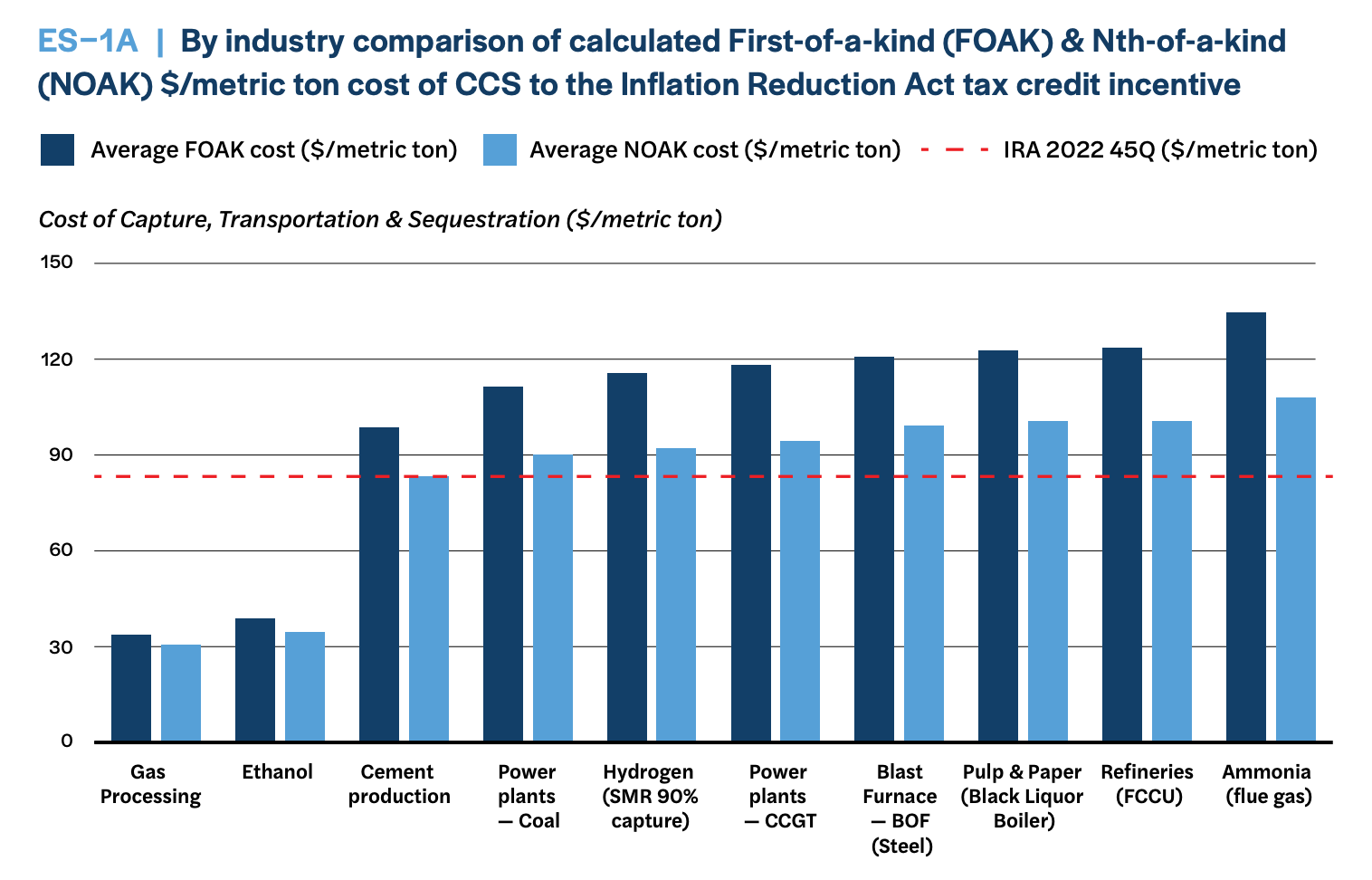

In February 2023, the Energy Futures Initiative (EFI), which is led by former Department of Energy Secretary Ernest Moniz and which supports widespread CCS deployment, released a report which found that the $85/MTCO2 CCS tax credit is not sufficient to motivate most industries, including coal and gas-fired power plants, to implement CCS.

The following chart compares the $85/MTCO2 45Q tax credit to the level of support EFI estimates will be required to induce facility owners to embrace CCS.

Source: Energy Futures Initiative

It’s not hard to understand why EFI arrived at its findings. In the IRA, the Biden administration and Congress took a largely “carrots-only” approach to motivating CO2 emitters to adopt CCS. The challenge with that approach is that, for it to appeal to polluters for whom CCS represents a cost increase without any offsetting increase in sales, the entire cost must be covered by the incentive. And the entire cost doesn’t include just the cost to install and operate the technology. It also includes the cost of borrowing the capital required to acquire and install the technology, the cost of operating it, and a competitive rate of return on the capital (profit, in other words) since any capital that is raised could in theory be put to other uses that would generate a return on investment.

These factors alone are capable of pushing the investment tipping point for both coal and gas plants well above the $85/MTCO2 incentive. Also, the $85 figure does not adjust for inflation. And, because the tax credit can only be taken as CO2 is captured over the course of the 12-year period specified in the law, plant owners who take the leap will have to be confident that inflation won’t greatly increase operating costs and that their plants will have consistently high usage rates for the entire duration of the subsidy at the very least.

That is quite a gamble when fossil fuel plants increasingly find themselves in competition with new wind and solar resources that are entering the market at price points that are now regularly at or below the price of electricity from gas and coal even before the additional cost of CCS is factored in.

Efforts to overcome CCS’s cost problem…and increase customer and taxpayer liability

Of course, CCS proponents are aware of these problems and are trying to come up with solutions. The Biden administration is trying to provide more money to the power generating industry by means of even more subsidies, including various loans and grant programs. It is also leaning on states to provide additional subsidies and to reduce costs to industry by reducing regulation and local barriers such as zoning restrictions that might get in the way of pipeline construction.

Also, the Biden administration isn’t using only carrots as it did with the BIL and IRA. Recently, the Environmental Protection Agency (EPA) announced new emission rules for coal-fired power plants and new gas plants that would, in many cases, basically require existing coal plants and new gas plants to either implement CCS or retire entirely by 2032 at the earliest and 2040 at the latest.

Many and perhaps most coal plants won’t last that long. Nonetheless, the industry is fighting the new rule ferociously. Lawsuits have already been filed in which the industry argues quite plausibly that CCS is neither affordable nor technologically ready to operate at commercial scale—two conditions that EPA rules must meet as a result of earlier Supreme Court rulings, including the case of West Virginia v. EPA.

Also, the EPA has yet to announce its new rule for existing gas-fired power plants, which, like the rule for coal plants and new gas plants, may add sticks to the existing carrots. Meanwhile, the coal and gas industries are lobbying in state capitals for additional subsidies and relaxation of health and safety regulations. A particularly worrying bill has entered the Pennsylvania legislature, which would open the door to allowing electric utilities to “rate base” CCS costs, which means that ratepayers might have to shoulder any costs not covered by other subsidies.

A final concern is that the 45Q tax credit for CCS can only be claimed for up to twelve years after a power plant installs and begins operating the technology. That leaves the question of what plants will do when they reach the end of the twelve years. If proposed EPA rules that would limit CO2 emissions are rejected by the Supreme Court, as many expect they will be, plants that installed CCS will be free to dismantle it or simply turn it off, which they may want to do since operating CCS typically reduces plant output by about 10% and increases operating costs.

CCS’s future and the tipping point

The question posed at the outset of this piece was whether CCS will become a niche decarbonization technology for just a few industries that lack effective decarbonization alternatives or one of the largest and most expensive infrastructure projects in the nation’s history. The answer to that question turns on whether CCS is widely deployed in the power generating sector.

If it is, coal and gas-fired power plants will become the principal nodes in a nationwide network of CO2 pipelines and sequestration sites. The amount of carbon captured and sequestered may double or triple what it would otherwise be. But the increase in cost and environmental and health risks would be far greater due to the need for new and massive pipeline networks. At the same time, the emissions from the power generating sector that would be captured and stored underground can be reduced more thoroughly and at far less expense by other means.

That’s why efforts to stop or at least rein in CCS should focus heavily on stopping it from infecting the fossil fuel power generating sector.