Pennsylvania Governor Josh Shapiro’s proposal for a hydrogen tax credit addresses some of the worst aspects of the existing tax credit but the tax credit still rewards polluters and leaves itself vulnerable to changes that could render it moot, unenforceable, or worse.

Background

Last month, legislation associated with Pennsylvania Governor Josh Shapiro’s Lightning Plan proposal was released to the public, including the language for House Bill 500. This bill seeks to reform portions of the Pennsylvania Economic Development for a Growing Economy (PA EDGE) tax credit, established in 2022 by House Bill 1059. In an effort to “attract a regional clean hydrogen hub in Pennsylvania”, PA EDGE provided $1 billion to support the purchase of hydrogen produced from a federally designated hydrogen hub or to purchase natural gas as “a short-term fail-safe in the event that… clean hydrogen is not initially available”.

However, less than a year later, Pennsylvania’s application to the Regional Clean Hydrogen Hub program was rejected, no hydrogen production facility has since been built in the Commonwealth, and, of course, no taxpayer has taken advantage of the hydrogen tax credit. (Notably, the dairy company the state was also courting with HB1059 chose New York to host its facility.) While Shapiro and other observers have used this as an opportunity to advance permitting reform narratives, the governor is also hoping to revamp the tax credit established by HB1059.

Restructuring the tax credit

At a glance, the proposal addresses some of the core issues with the existing hydrogen tax credit available through PA EDGE. Rather than supporting a single massive project, HB500 seeks to break up the tax credit and makes it easier for more companies to access.

First, the legislation allows up to $7M each to seven qualified taxpayers each fiscal year, a slight decrease from $50M in the original bill. The proposal specifies that two of these recipients should be located east of the Susquehanna River, two west of the Susquehanna River, one located in a fifth, sixth, seventh, or eighth class county, and two anywhere in Pennsylvania.

The bill also proposes easing the requirements for accessing the hydrogen tax credit. PA EDGE currently requires a company to create 1,200 jobs in order to be eligible but HB500 lowers this to only 200 jobs. Similarly, the private investment needed to be eligible would be set at $100,000 instead of the current threshold of $500,000. The bill also expands the list of eligible uses of hydrogen to include “aviation fuel production, heat and energy generation or transportation and logistics at the project facility” rather than just manufacturing.

Finally, the bill no longer limits eligibility only to hydrogen produced by a federally designated hub — projects that aren’t expected to produce hydrogen for several years. Instead, any hydrogen that is determined to have an emissions intensity of less than four kilograms of CO2e per kilogram of hydrogen would be considered eligible for the updated PA EDGE hydrogen tax credit. This definition more accurately reflects the hydrogen hub concept and the nature of the project buildout — a loose network of producers and customers stitched together by pipelines and storage infrastructure.

A clear definition for eligible hydrogen is a strong improvement on the current, much more discretionary, definition. HB500 also drops direct support for purchasing natural gas, which addresses one of the existing tax credits’ most egregious failings. However, even with these changes, the updated tax credit will still be a significant boon to natural gas companies.

House Bill 500 in context

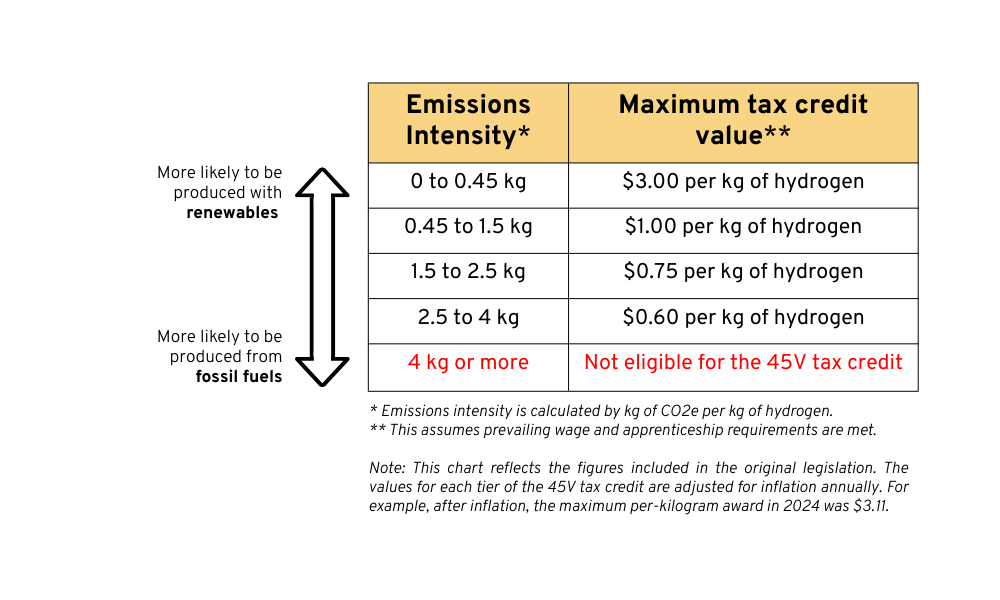

To understand the real-world impact of House Bill 500, we first need to look at the structure of the federal hydrogen tax credit, 45V. Established by the Inflation Reduction Act of 2022, the 45V tax credit awards up to $3 per kilogram of hydrogen on a four-tier system, with higher awards given to hydrogen with little to no emissions impact.

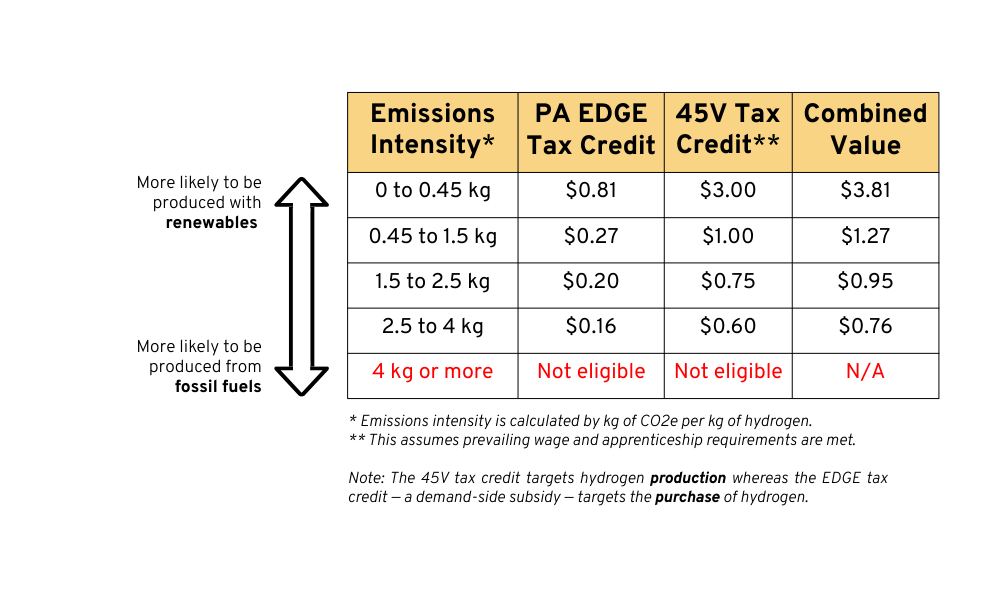

Like the federal hydrogen tax credit, HB500 awards different tax credit amounts depending on emissions intensity. This is in contrast to the existing PA EDGE hydrogen tax credit which awards a flat tax credit value to all eligible hydrogen and relies on a poorly defined federal standard. As currently written, PA EDGE incentivizes hydrogen that has been determined by federal regulators to “demonstrably aid achievement of the Clean Hydrogen Production Standard”, a standard which is neither a regulatory standard nor a requirement that producers affiliated with a hydrogen hub are required to meet. Rather than rely on an ill-defined and discretionary determination, HB500 improves on the existing PA EDGE hydrogen credit by using measurable emissions intensity to determine whether hydrogen is eligible to receive the tax credit and how large of a credit any eligible hydrogen could receive. The tax credit also awards a higher value to less emissions-intensive hydrogen, which is more likely to be produced using renewable energy and electrolysis rather than with natural gas.

However, these two hydrogen tax credits stack and we can see the true impact of HB500 when examining the combined value of the two tax credits.

As seen in the preceding chart, the availability of the tax credit established by HB500 would increase the value of the most carbon-intensive hydrogen supported by the federal tax credit to such a degree that hydrogen otherwise eligible for the fourth tier (which awards $0.60 per kilogram) instead receives a combined tax credit on par with the third tier and all but moves the third tier up to the second. HB500 does evenly increase the tax credit value for all four tiers of hydrogen on a percentage basis but comparing the impact to the original tiers underscores the incentive given to both fossil fuel-based hydrogen production and the natural gas companies that would provide the feedstock to produce this more carbon-intensive hydrogen.

A critical design flaw

As previously discussed, the decision to tie the value of the tax credit to the hydrogen’s emission intensity is an improvement to the structure of the current tax credit. HB500 relies on the 45V rules released by the Department of Treasury earlier this year to determine the hydrogen’s lifecycle greenhouse gas emissions. These rules include a version of the critical ‘three pillars’ protections needed to ensure hydrogen produced using renewable energy does not indirectly result in higher overall emissions. The rules also do not allow companies like CNX and TransGas to profit from wasteful coal mine practices by repurposing 45V in order to support the production of hydrogen from coal mine methane.

Unfortunately, these rules are at great risk of being rewritten, a development which would have significant downstream effects in Pennsylvania. If the current federal administration decides to expand 45V’s support for hydrogen produced using natural gas — perhaps by loosening the methodology used to assess the lifecycle emissions — this would automatically restructure the state-level tax credit. This is because HB500 specifically cites the 45V rules when defining the tax credit’s tiered structure. Additionally, the tax credit itself may go away entirely should Congress act to repeal parts or all of the Inflation Reduction Act, meaning that Pennsylvania would be left without a methodology for assessing the emissions intensity of any hydrogen under consideration for the tax credit. Indeed, the influential U.S. House Committee on Ways and Means is proposing to terminate the 45V tax credit. Meanwhile, House Bill 500, which relies on these rules, has cleared the Pennsylvania House of Representatives and awaits introduction in the state senate.

Rewriting HB500 to include a methodology for calculating the lifecycle greenhouse gas emissions based on the existing 45V rules would ensure that the steps taken by the drafters of this bill to improve on the deficiencies of HB1059 would not be undone by any actions at the federal level.

Closing

It’s arguable whether a hydrogen tax credit is what the Commonwealth needs at this stage to drive industrial decarbonization. Even if revamped by HB500, the PA EDGE hydrogen tax credit would be insufficient to drive any meaningful hydrogen production on its own should the federal tax credit be eliminated — a scenario that appears increasingly likely. To be sure, it’s expected that some small amount of hydrogen fuel switching is needed to help mitigate the emissions from a handful of hard-to-electrify sectors in Pennsylvania. However, if public officials are serious about reducing emissions from industrial processes, they should also be investing in the proven strategies that will address the bulk of emissions in Pennsylvania — ramping up renewable energy, widespread electrification, and investing in energy efficiency. These interventions are much more impactful and more cost-effective than trying to shoehorn hydrogen into applications that don’t make sense, such as the support for heating and power sector applications included in this bill.

Once again, it’s time for a reality check. No taxpayer has taken advantage of the PA EDGE hydrogen tax credit so it’s not too late to turn back. Our leaders can start by unwinding this shortsighted subsidy and advocating for the solutions Pennsylvanians deserve.

Note: House Bill 500 also includes support for sustainable aviation fuel (SAF) produced using biomass or natural gas feedstocks. Capped at $15 million a year, the eligibility requirements for this $0.75/gallon SAF credit includes making an investment of at least $250,000 and creating 400 jobs. Because the SAF tax credit comes from any unallocated funds from the hydrogen tax credit, we chose to focus on the primary purpose of House Bill 500 — incentivizing hydrogen production — and may discuss the SAF tax credit in a future article.