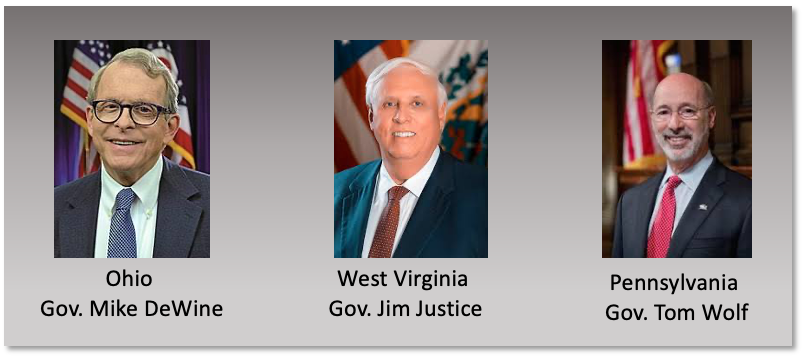

The following public letter concerning economic development, the petrochemical industry, and the need for more viable and sustainable strategies was sent to the governors of Ohio, West Virginia, and Pennsylvania on June 15, 2020. See this background brief to learn more about the rationale and motivation for the letter.

June 15, 2020

Dear Governors DeWine, Justice, and Wolf,

In Ohio, Pennsylvania, and West Virginia, our goals for economic growth and job creation are being undermined by the mistaken belief that the region’s petrochemical and plastics manufacturing industries are poised to greatly expand and, in the process, generate large numbers of new jobs. In fact, no such expansion and jobs boom is likely. And, unless we adopt new and better development strategies, we risk squandering hundreds of millions of dollars in public funds in pursuit of a vision that will not materialize.

The recent cancellation of the ASCENT ethane cracker in Wood County, West Virginia, the indefinite postponement of a final investment decision on the proposed Belmont County, Ohio cracker, the failure of the proposed Appalachian Storage Hub (ASH) to attract private investors, and the failure by China to follow through on an announced investment of $84 billion in in the region are just the most visible signs that the vision of an economic renaissance driven by an expansion of petrochemicals and plastics manufacturing is an economic non-starter.

That is why we — a group of economists, engineers, public policy analysts, and former policymakers who are affiliated with some of the region’s leading institutions – have concluded that regional leaders need to explore more feasible and sustainable economic development strategies. Some of the reasons are contained in a recent study from the Institute for Energy Economics and Financial Analysis (IEEFA), which determined that a proposed cracker in Belmont County, Ohio has become too risky an investment to go forward. IEEFA has been joined in that conclusion by Moody’s, Fitch’s, and IHS Markit.

We also see additional economic and technological barriers, which are likely to outlast the current economic crisis and make the construction of more crackers in the Ohio Valley and Southwestern Pennsylvania highly unlikely. Consequently, projects that depend on a buildout of four to five crackers, including development of large natural gas liquids storage facilities such as the proposed ASH and a major expansion of the downstream plastics manufacturing sector, are also unlikely to be realized as are the jobs they are expected to provide.

At the same time that prospects in our region are dwindling, competition is growing rapidly elsewhere. In just the past two years, ethylene and polyethylene production capacity in the US has increased by 50 percent, principally along the Gulf Coast, creating a condition of oversupply that the IEEFA analysis doesn’t see closing until 2026. The global buildout is even greater, with Wood Mackenzie forecasting a “meteoric expansion” of ethylene capacity in China over the next five years. As a result, IHS Markit forecasts an imminent plunge in global cracker utilization rates.

Another discouraging factor is that, even before the recent coronavirus crisis and the associated economic slowdown, the financial condition of the region’s gas drilling industry was dire. And the best cure for the industry’s condition – a rise in natural gas prices – would further reduce the competitiveness of petrochemicals from the region by driving up the cost of the ethane feedstocks. Additional barriers are presented by questions about the speed of general economic recovery and whether global and domestic demand for plastics and chemicals will meet pre-crisis expectations.

These are just the economic conditions that are creating intolerable risks for prospective investors. There are additional factors as well. Petrochemical and plastics manufacturing are emissions-intensive activities that are vulnerable to government actions to reduce greenhouse gases, such as carbon taxes and caps, for which pressure is growing in the United States and globally. At the same time, the pace of growth in the plastics market is being thrown into question as national, regional, and local governments, including recently China, enact measures designed to reduce plastics consumption and pollution.

Meanwhile, the vision of our region becoming a petrochemical hub comparable to the Gulf Coast also faces severe technological challenges. Ethane from the Marcellus/Utica fields does not contain aromatics and other chemicals, which are essential components in the manufacture of many products. Most of the ethylene and polyethylene produced in this region is, therefore, likely to be shipped elsewhere – primarily China — for manufacturing, which severely undercuts prospects for manufacturing job growth here.

Finally, health and environmental risks associated with a petrochemical buildout, can’t be overlooked. In addition to being major emitters of greenhouse gases, ethane cracker plants, processing facilities, and downstream manufacturers are also emitters of fine particulate matter as well as volatile organic compounds (VOCs). Residents in our region already suffer higher than average rates of cancer, cardiovascular disease, upper respiratory disease, obesity, diabetes, and other conditions that make our region’s population among the nation’s most vulnerable to adverse health consequences from these substances.

For these many economic, technological, environmental, and health reasons, we believe our states need more viable, just, and sustainable development strategies that create jobs and provide the tools and resources needed by workers and communities, especially those that have been disproportionately affected by deindustrialization, to successfully transition. One area of special promise is the clean energy economy – electric vehicles, energy storage, wind power, solar power, and energy efficiency — which already employs more than 175,000 workers in Ohio, Pennsylvania, and West Virginia, three quarters of them in manufacturing and construction.

The clean energy economy offers large-scale, high-visibility opportunities, like the Lordstown Motors electric truck plant in Ohio as well as new opportunities for existing businesses in communities all over our region in fields like lighting, HVAC, construction, building maintenance, and energy efficiency retrofits. The construction of high-efficiency buildings and the retrofitting of existing buildings and homes generates knock-on benefits, including reduced demand for electricity, lower utility bills for ratepayers, greater comfort for workers and residents, and fewer greenhouse gas emissions.

We ask you to help stop the squandering of public funds and resources in pursuit of an imagined petrochemical boom. Instead our region’s efforts should be focused on alternative economic development strategies, which can attract new businesses and expand opportunities for existing ones while creating new jobs up and down the skills ladder in communities throughout our region.

Thank you for your consideration.

Sincerely,

Ted Boettner

Ted Boettner

Executive Director

West Virginia Center on Budget and Policy

Wilfrid Csaplar, Jr. PhD

Wilfrid Csaplar, Jr. PhD

Professor of Economics

Bethany College

John Hanger, J.D.

John Hanger, J.D.

Hanger Consulting, LLC

Former Pennsylvania Secretary of Environmental Protection

Nicholas Z. Muller, PhD

Nicholas Z. Muller, PhD

Associate Professor of Economics, Engineering, and Public Policy

Lester and Judith Lave Development Chair in Economics, Engineering, and Public Policy; Carnegie Mellon University

Mark Partridge, PhD

Mark Partridge, PhD

President Regional Science Association International

Swank Chair in Rural-Urban Policy/Prof., AED Economics, The Ohio State University; Adjunct Professor, School of Economics, Jinan Univ. Guangzhou, China; Social Sciences Dept., Gran Sasso Science Institute, L’Aquila, Italy;

Coordinating Editor Springer Briefs in Regional Science

John B. Russo, EdD

John B. Russo, EdD

Founder and former director

Center for Working-Class Studies

Youngstown State University

James Van Nostrand, J.D., LLM, MA in economics

James Van Nostrand, J.D., LLM, MA in economics

Associate Professor

Director, Center for Energy and Sustainable Development

West Virginia University College of Law

Amanda Weinstein, PhD

Amanda Weinstein, PhD

Assistant Professor of Economics

University of Akron