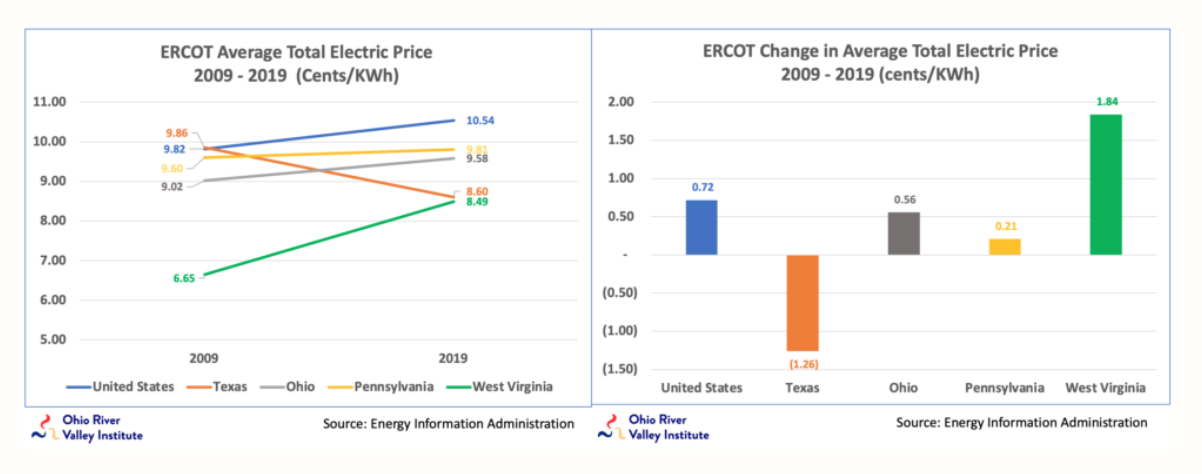

Almost three years ago I wrote a blog post titled, “Renewable Energy: The New Texas Tea.” In it, I compared changes in electric rates in Texas, where what would become a rapid transition to renewable energy was gathering steam, with changes in rates in Ohio, Pennsylvania, and West Virginia, where, in Ohio and Pennsylvania at least, the Appalachian shale gas boom was reshaping power generation and was reputed to be saving ratepayers millions of dollars on their electric bills.

I was reminded of the blog post a couple of days ago when Nick DeIuliis, CEO of Pennsylvania natural gas producer, CNX, dropped this X post in which he compares the savings the “shale industry” has bestowed on consumers with the “incremental cost” he attributes to electricity from wind and solar power.

He concludes his post by saying, “Energy transition isn’t about CO2; [it’s]about making energy expensive.”

DeIuliis’ arguments require that readers assume a casual attitude toward factuality and have a high tolerance for logical fallacy. In this case, for instance, the “shale industry” in the study to which he alludes (but avoids linking) isn’t actually shale gas – it’s shale oil. And the savings aren’t from lower electric bills, but mostly from gasoline and fuel oil spending. Still, we can squint and grasp the point that DeIuliis is attempting to make. He is arguing (incorrectly) that natural gas drives down electric rates while wind and solar drive them up.

Of course, this claim is directly opposed to the point I made in my 2021 blog post, which found that, during the initial decade of the Appalachian natural gas boom, electric rates had gone up in Ohio, Pennsylvania, and West Virginia, while they went down as renewable energy took hold in Texas.

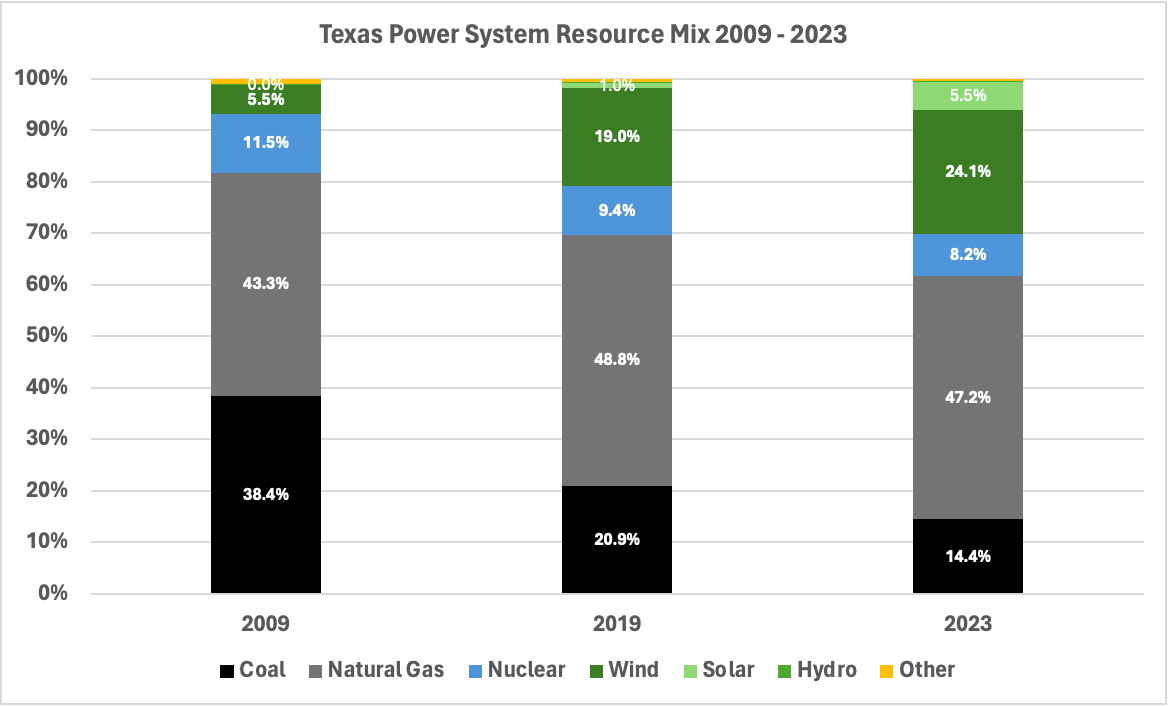

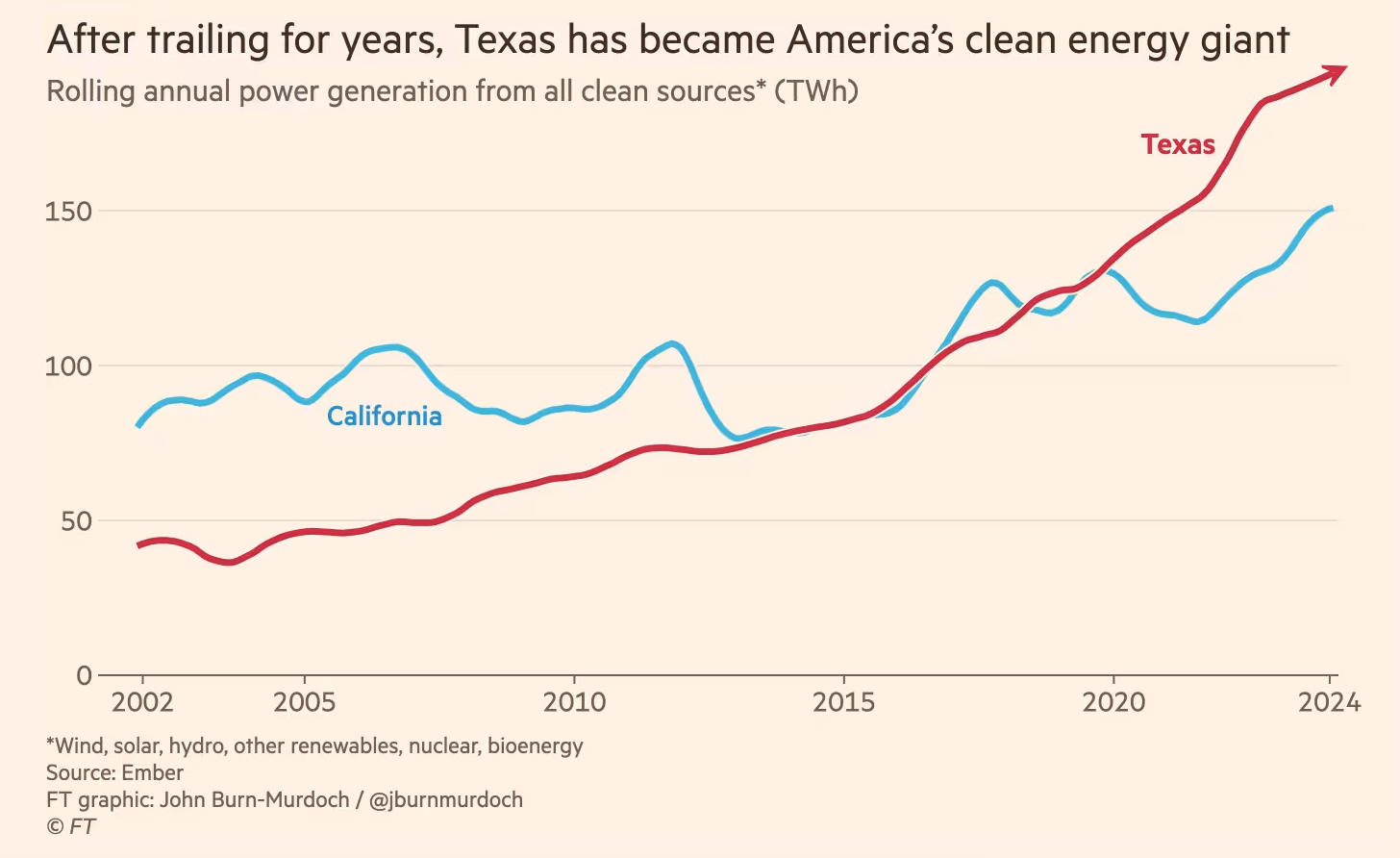

At that time, wind and solar had grown from less than a 6% share of generation in Texas in 2009 to a 20% share in 2019, which effectively tied it with coal power. Meanwhile, the natural gas share was 47%.

But perhaps something had changed in the intervening 31 months to justify DeIuliis’ dredging up an argument that, back then at least, had been a canard. So I ran the numbers again, using data just released by the Energy Information Administration.

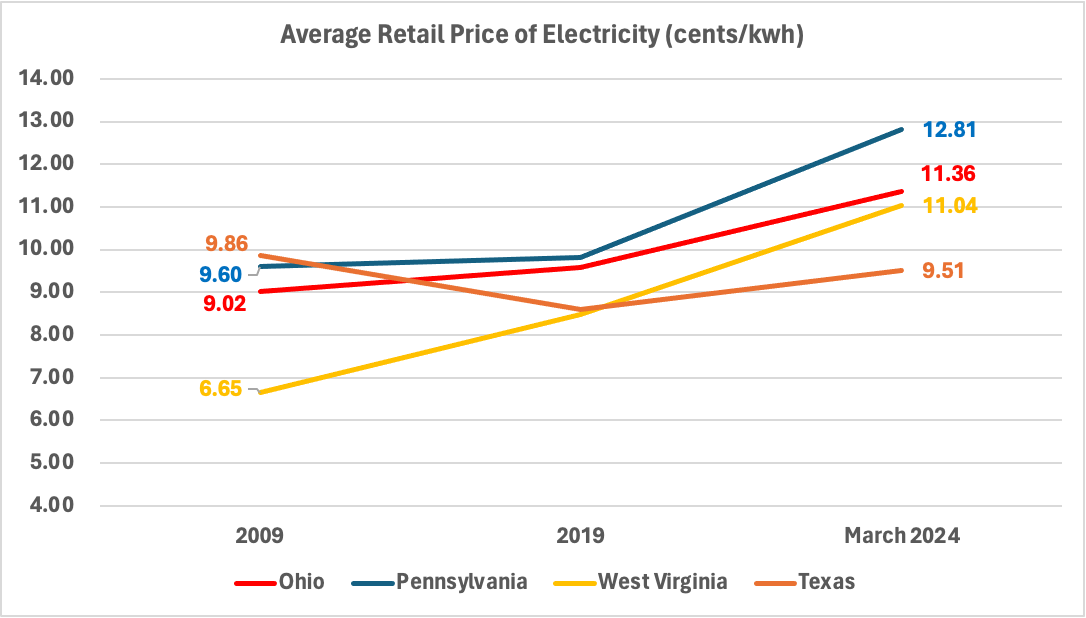

Far from changing, the trends intensified. Ohio, Pennsylvania, and West Virginia’s electricity rates became even less competitive compared to rates in Texas. And that’s not because any of the states changed strategies or deviated from their previous resource mix trajectories.

Texas’ transition to renewables had actually accelerated. In 2023, wind and solar had grown to almost 30% of generation and gas was essentially unchanged from 2019, at about 47%.

In Ohio and Pennsylvania on the other hand, less than 3% of generation came from renewables in 2023 and natural gas had increased its share of generation in both states from 43% in 2019 to 59%. That’s right – as the share of electricity generated by natural gas increased by 16%, consumers in Ohio and Pennsylvania paid even higher rates, directly counter to Deluliis’ argument.

The situation in West Virginia was essentially unchanged, with coal’s share of generation declining slightly from 93% in 2019 to 88% in 2023, with a small but surprising upsurge in wind and hydro, which rose to 6%. However, despite a relatively unchanged generation mix, rates in West Virginia also continued to climb.

Now let’s again examine Texas, which had the highest average retail rate for electricity in 2009 and which was the only one of the four states to experience a large-scale increase in wind and solar. Texas actually saw its nominal average retail rate for electricity decline by 3.5% in the 15 years from 2009 to 2024. Meanwhile, rates in Ohio and Pennsylvania increased by 26% and 33%, respectively. And coal-reliant West Virginia endured a 66% increase.

In addition to making Nick DeIuliis look silly, the Texas example shows that, when bureaucratic barriers are removed, the transition to renewables can happen quite quickly, as discussed in this recent piece for the Financial Times by John Burn-Murdoch.

It’s a change that Ohio, Pennsylvania, and West Virginia can and should pursue.