I’ve gotten better at resisting the urge to respond to every inaccurate claim, every attempt to mislead, and every rhetorical flourish that issues forth from the region’s oil and gas industry executives who, when they’re not claiming that natural gas is “clean energy”, are telling us that it doesn’t matter whether it’s clean or not, since climate change is a liberal hoax. But sometimes they attach numbers to their nonsense, creating myths so obvious that they beg to be shattered.

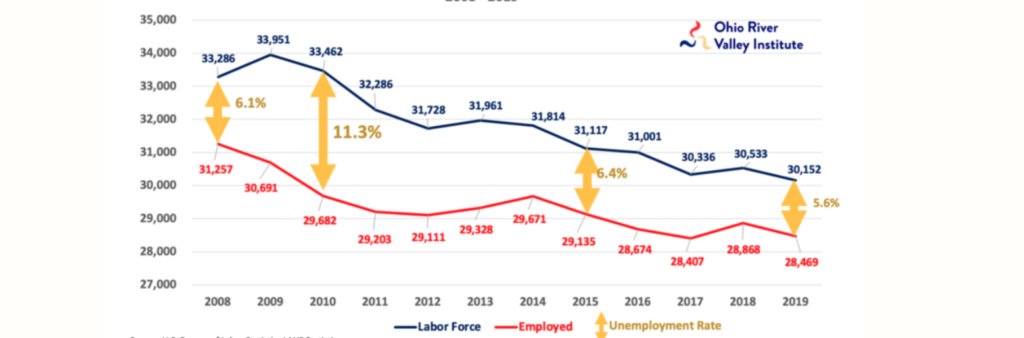

A couple of years ago Mike Chadsey of the Ohio Oil & Gas Association blurted out in a TV interview that the natural gas industry must be good for jobs and the economy because unemployment rates in Ohio’s natural gas counties were dropping. What Chadsey didn’t explain, either because he didn’t know or didn’t care, was that, despite the declining unemployment rate, the number of people with jobs in those counties was actually going down. The unemployment wasn’t falling because people were finding jobs. It was falling because the labor force was declining even faster than jobs were being lost as folks gave up and dropped out of the labor force or moved out of the area in search of work elsewhere.

Figure 1: Belmont County, Ohio Labor Force, Employed Persons, and Unemployment Rate, 2008-2019

Source: Bureau of Labor Statistics, Local Area Unemployment Statistics

Stephanie Catarino Wissman, executive director of the American Petroleum Institute in Pennsylvania, is another Chadsey-like myth weaver. Reading her recent piece in Broad & Main titled “Pennsylvania prospers when we lead on energy production”, I managed to get through the first two paragraphs about the immense contributions oil and gas are making to Pennsylvania’s gross domestic product, as though oil and gas-driven GDP growth has anything to do with job creation or a higher standard of living. (Hint: It doesn’t, but we’ll come back to that.) But then I got to this paragraph.

“Beyond the billions of dollars injected into our state’s economy, the (oil and gas) industry supports over 93,000 direct natural gas and oil jobs and over 330,000 indirect jobs — from truck drivers to contractors and manufacturers — or 5.6 percent of Pennsylvania’s total employment. To put this into perspective, the total number of jobs supported by industry in Pennsylvania alone is equal to four times the capacity of Penn State University’s Beaver Stadium.”

To put it bluntly, the only way that’s true is if someone – probably one of those liberals – steals three-quarters of Beaver Stadium’s seats. How can you tell? Because Wissman’s figures come from the American Petroleum Institute’s “Impacts of the oil and natural gas industry on the US economy in 2021”. This edition, published in April of this year, provides a state-by-state breakdown of the oil and gas industry’s ostensible economic impacts. For Pennsylvania, the headline is 423,700 supported jobs, more than one out of every twenty jobs in the Commonwealth.

Is that really true? Of course not. But what’s entertaining is ascertaining how API and Wissman got to such a grandiose and inaccurate number. Recall that they started with 93,000 workers who they say are directly employed by the industry. That number is believable. It comes from the US Bureau of Labor Statistics’ Quarterly Census of Employment and Wages (QCEW), which counts the number of actual jobs that qualify for unemployment insurance. The exact QCEW number for oil and gas jobs in Pennsylvania in 2021 was 81,432. But API has used a formula to take into account self-employed people and part-time workers who don’t qualify for unemployment insurance, which results in a combined figure of 93,060. That’s plausible. But where in the hell do the other 330,640 jobs come from?

API and Wissman say they’re people who work in other industries that are “supported” by oil and gas. Some of these jobs are called “indirect” because they’re found in industries from which oil and gas companies purchase goods and services – think cleaning companies, transport companies, and accounting and other professional services. Other jobs are called “induced” because people who work for oil and gas companies spend their wages with local merchants causing them to hire more workers – think of folks who work at the local Wal-Mart or Giant Eagle. Since there is no paper trail to facilitate a count of these indirect and induced jobs, how does API arrive at its figure?

They infer. They do so by using an economic tool called “multipliers”. Multipliers are, to put it politely, estimates. In the best case scenario, these estimates are carefully calculated using large and complex data sets examined by impartial data scientists and economists. Multipliers arrived at in this way are usually quite small and generally find that only 0 to 2 indirect and induced jobs are created for every direct job. However, industry-sponsored economic impact studies often use “one-size fits all” software models into which they plug exaggerated multipliers. That has been the case before with the American Petroleum Institute, which was responsible for one of the more notoriously flawed economic impact studies, when in 2010 it predicted that the shale natural gas boom would add over 200,000 jobs to Pennsylvania’s economy. The study has since been removed from API’s website.

But that’s not the only problem. There’s also the issue of double counting. API conveniently tells us that more than half of the 330,640 indirect and induced jobs are in the Services industry. Well, let’s imagine for a moment that the Services industry decides to do its own economic impact report. If it does so, it will count every one of those 172,740 jobs as directly employed, meaning that, if you add the results of the Services economic impact report to the Oil & Gas report, those 172,740 workers will be double-counted. And, as more industries do economic impact reports, the amount of double-counting grows exponentially so that by the end of the exercise, if all major industries in Pennsylvania do similarly structured economic impact reports and you combine their results, you will find that the collective number of jobs they “support” is many times greater than the number of jobs that actually exist.

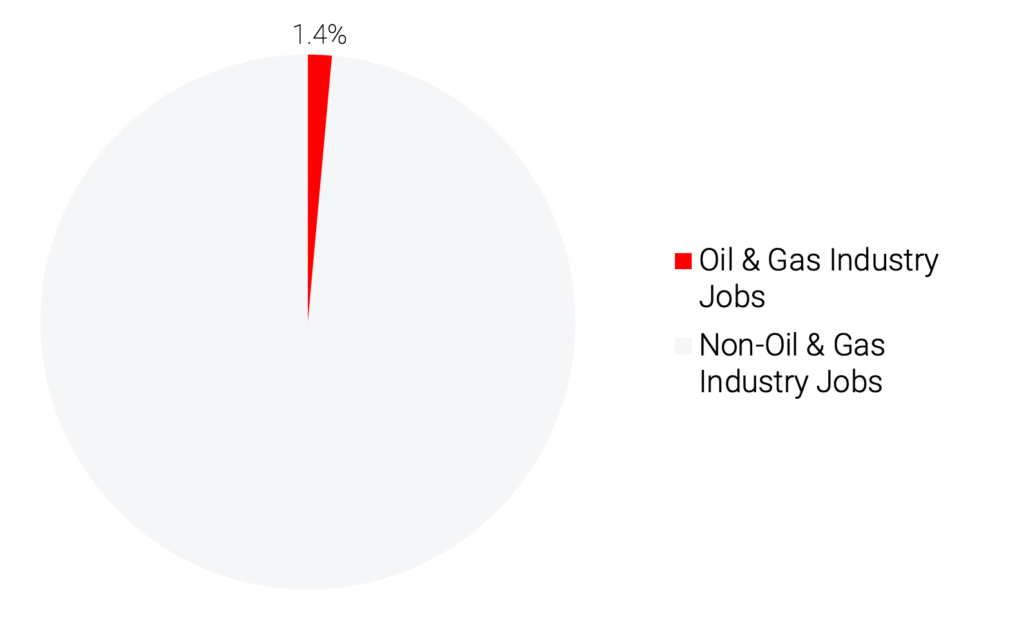

But let’s return to reality. If we confine ourselves to the actual numbers from the QCEW, Pennsylvania’s oil and gas industry provides 81,432 out of the state’s total of 5,650,325 jobs, or 1.44%, roughly a quarter of the figure cited by Wissman. Also, between the start of the natural gas boom in 2008 and 2021, the industry added just 15,823 jobs, which is a nice rate of growth. But when the number you start with is so small, even a nice rate of growth doesn’t amount to much in an economy of over 5 million jobs. In fact, the oil and gas industry’s share of jobs in Pennsylvania’s economy has only increased by only a quarter of one percent – going from 1.18% to 1.44% – over the entire period of the natural gas boom. And – this will come as a surprise to many – most oil and gas jobs in Pennsylvania are pretty crappy.

Figure 2: Share of Jobs in Pennsylvania, 2021

Source: Bureau of Labor Statistics

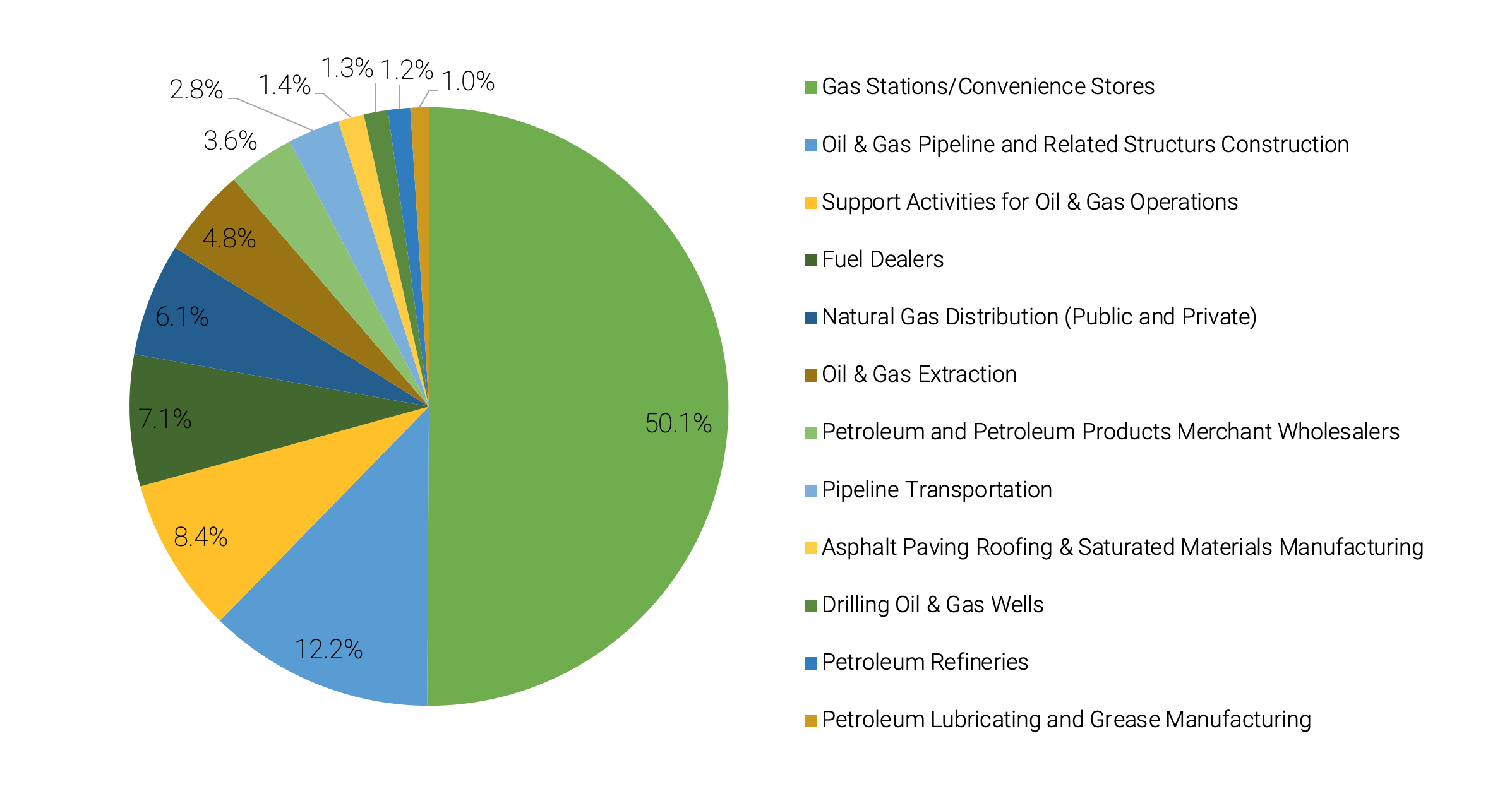

The oil and gas industry has a reputation for providing some of the highest paid blue collar jobs in the economy, which is true. Jobs in extraction, pipelines, refineries, and asphalt products all pay an average of more than $100,000 a year. Others in support activities, distribution, and manufacturing pay more than $80,000 a year. But they make up less than half of all oil and gas jobs. The majority of oil and gas workers, 42,780, are employed at gas stations and convenience stores and their average salary is $25,227 a year. In fact, the average wage of all Pennsylvania oil and gas workers is 4% less than the average salary of all workers in the state.

Figure 3: Distribution of Oil & Gas Industry Jobs in Pennsylvania, 2021

Source: Bureau of Labor Statistics

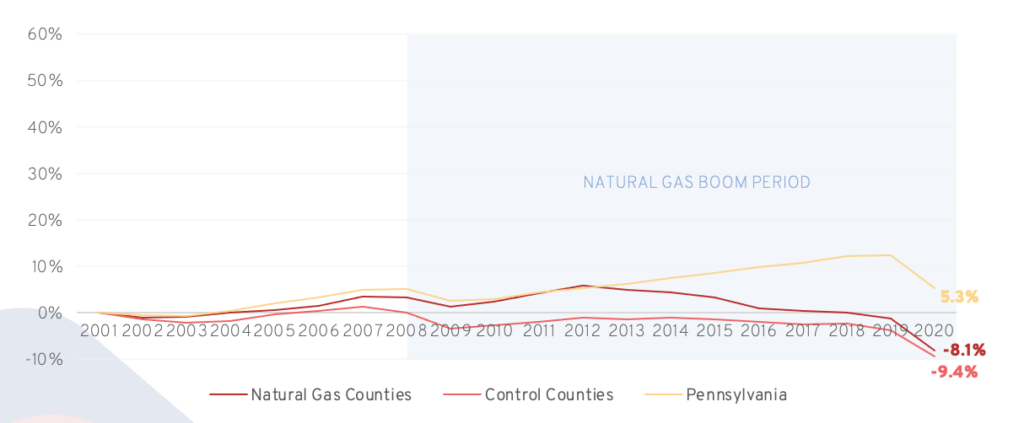

Finally, let’s get back to the issue of how much oil and gas-driven GDP growth has contributed to job creation and prosperity in Pennsylvania. Last year ORVI issued a report titled “Misplaced Faith: How Policymakers’ Belief in Natural Gas is Driving Rural Pennsylvania Into an Economic Dead End”. The report specifically examined the question of whether Pennsylvania counties that experienced major GDP growth as a result of oil and gas experienced greater job growth and prosperity than comparable counties that had little involvement in the natural gas boom and experienced little or no GDP growth.

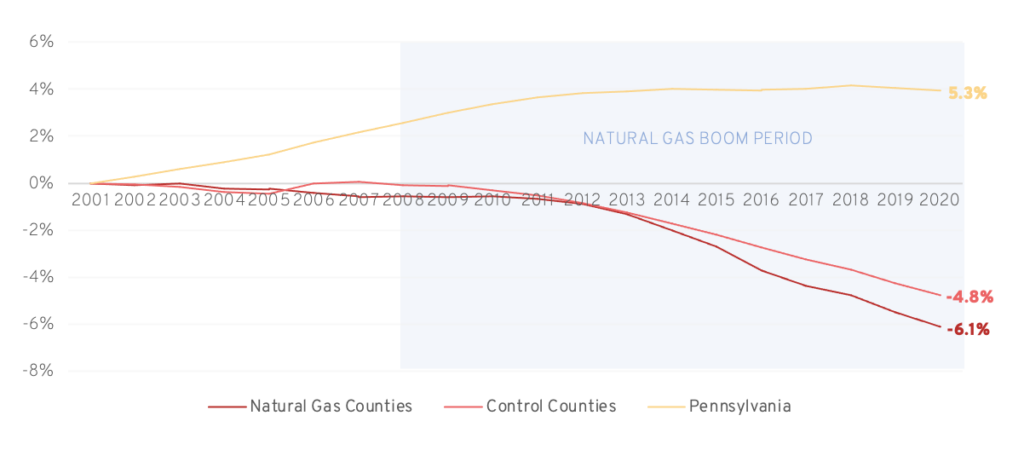

The finding was that they did not. Between 2001 and 2020 natural gas counties experienced three times the GDP growth of non-gas counties. But their job growth (job loss, actually) of -8.1% was comparable to that of the non-gas counties, which came in at -9.4%. And the gas counties’ population loss was greater than that of the non-gas counties, -6.1% to -4.8%. Meanwhile, when we removed the effects of the natural gas boom from GDP, the gas and non-gas counties’ performance was statistically identical. In other words, the natural gas boom happened in a proverbial bubble and had little or no effect on the economic prospects in the counties where it was centered.

Figure 4: Change in Total Employment, 2001-2020

Source: Author’s calculations using Bureau of Economic Analysis data

Figure 5: Change in Population, 2001-2020

Source: Author’s calculations using Bureau of Economic Analysis data

Near the end of her article, Wissman writes, “. . . the natural gas and oil industry remains central to Pennsylvania’s economy.” Central? Really? Does an industry that provides less than a percent and a half of jobs qualify as “central”? Should one that pays less than average wages qualify as central? And is an industry whose growth is utterly detached from the economic wellbeing of the communities where it is most prevalent worthy of being seen and treated as central?

Industry voices like Wissman’s and an assortment of politicians say yes. But the numbers, and the reality, say no.